Bad loans cut into banks' profits in 2014

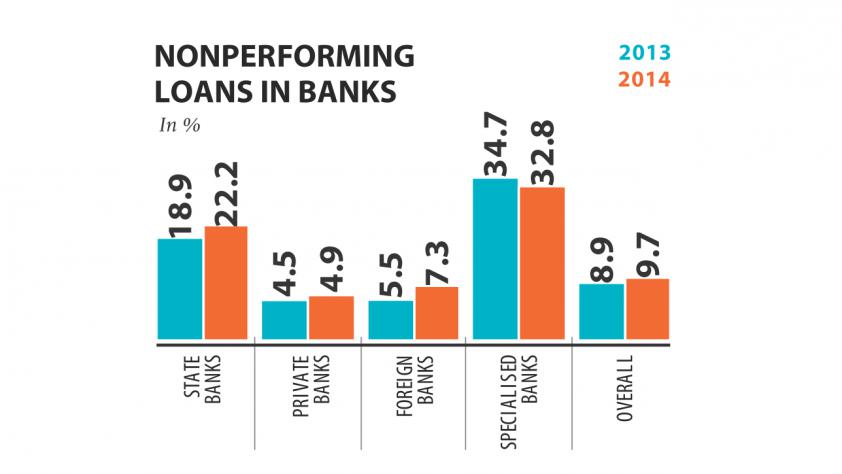

High nonperforming loans (NPLs) eroded banks' earnings last year, the central bank said in a report yesterday.

Subsequently in 2014, return on asset and return on equity, the two major indicators to measure a bank's profitability, decreased by 20 and 260 basis points to 0.7 and 8.1 percent respectively from a year ago.

The rise in NPLs last year forced banks to set aside a major portion of their profits for provisioning, said SK Sur Chowdhury, deputy governor of Bangladesh Bank, at the unveiling of the Financial Stability Report 2014.

Chowdhury blamed the high NPL of state banks for the overall profit decline in the banking industry.

Non-interest income has increased the banking sector's operating profits 14.3 percent year-on-year to Tk 21,270 crore in 2014, according to the report.

Yet, the net profit of the industry has declined 17.3 percent to Tk 6,000 crore last year, mainly due to the extensive growth in bad debt provisions.

The amount of provisions almost doubled to Tk 8,430 crore last year from Tk 4,610 crore a year ago, according to data from the BB.

The report reviewed macroeconomic developments and analysed the financial performance of banks and non-banks, the money and capital markets.

The latest report, for the first time, has included microfinance institutes.

The report found the banking sector's capital adequacy ratio (CAR) to be 11.4 percent at the end of 2014, which is slightly higher than the minimum requirement of 10 percent.

Banks having CARs within the range of 10 to 16 percent hold 79 percent of the overall banking assets, which according to the BB indicates financial stability.

Liquidity stress remained at an acceptable level in 2014 due to the stable call money rate and the desired level of loan-deposit ratio of 70.98 percent. The call money rate was within the 6-8 percent range.

Term deposits accounted for 56.4 percent of total deposits, which shows the banking sector's greater reliance on term deposits and contributes to the stability of the financial system.

However, the risk was with the concentration of deposits with few banks, as 51.7 percent of the deposits were with just ten banks.

The report said this concentration is expected to be reduced gradually as nine new banks will try to collect deposits from the market.

The report revealed that the capacity of the BB-formed Deposit Insurance Trust Fund has been increased to Tk 363.6 crore, enough to reimburse the deposit claims of 26 banks. The fund is expected to reach over Tk 1,000 crore in 2019.

The report also analysed the risks of the banks.

Credit risk appears to be the most significant with 85.7 percent of the total Risk Weighted Assets of the banking system. The risk was mostly from on-balance sheet items.

The report said stress testing results revealed that the individual banks and the banking system, as a whole, are resilient enough to different levels of stress scenarios.

It said banks are resilient for more than five business days with severe liquidity stresses.

On non-bank financial institutions (NBFIs), the stability report found that their asset quality improved in 2014.

Classified loans and leases dropped 30 basis points to 5.3 percent. On the other hand, CAR has increased 290 basis points to 21.2 percent. Stress test results revealed that 23 of the 31 NBFIs were resilient in 2014.

As the size of the MFIs is relatively smaller compared to the banking sector, it does not pose any immediate threat to the stability of the financial system.

Asset size of the MFIs is only 5 percent of the banking sector. Besides, MFIs have much lower NPLs -- 4.18 percent -- compared to that of the banking industry.

On the capital and foreign exchange markets, the report said these areas remain stable now despite some volatility last year.

Chowdhury also spoke on the BB programmes that have been taken to strengthen the capacity of the banks and NBFIs.

The BB has decided to start the implementation of Basel III framework from 2015, aiming to strengthen the capital base of the banking sector and enhance risk resilience as well.

He said the central bank has also taken an initiative to develop a 'Coordinated Supervision Framework' involving all other financial regulators to avoid contradictions and unnecessary duplications.

Ali Reza Iftekhar, chairman of Association of Bankers, Bangladesh and chief executive of Eastern Bank, and Selim RF Hussain, chief executive of IDLC Finance, spoke on behalf of banks and NBFIs respectively at the programme.

News:The Daily Star/27-Jul-2015ADVERTISEMENT

Other Posts

- Md Sirajul Islam Varosha, Chairman, Board of Directors of Jamuna Bank Limited inaugurating the business review meeting of Sylhet Zone of the bank at Dusai Resort & Spa, Moulvibazar. Shafiqul Alam, Managing Director of the bank presided.

- BB disburses Tk 14,000cr through refinance schemes

- Exim Bank reappoints MD

- Shaikh Salahuddin, Chairman of the Board's Audit Committee of Modhumoti Bank Limited, presiding over the committee meeting at its Gulshan Branch in the city on Sunday. Md Abul Hossain, A Mannan Khan and Md Mizanur Rahman, Managing Director of the bank wer

- IBBL ranked among top 1000 banks of the world

- FSIBL inaugurates 17th foundation training course

- Governor asks banks to bring down default loan soon

- Listed banks show strength despite chaos in first quarter

Comments