Banks see sharp drop in profits

Sajjadur Rahman

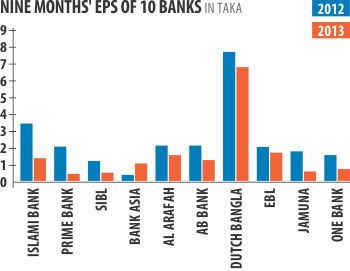

Islami Bank Bangladesh Ltd, a leading private sector bank, has made a profit of a mere Tk 20 lakh in the third quarter this year, down from more than Tk 83 crore during the same period last year.

Its nine-month profit (after tax) slid to Tk 194 crore this fiscal year against Tk 505 crore a year ago.

Prime Bank’s nine-month profit went down to Tk 43 crore this year from Tk 212 crore at the same time last year.

Almost all banks — from Mutual Trust to Dhaka Bank, SIBL, Eastern Bank and AB Bank — saw their net profits fall drastically during the first nine months this year compared to the same period last year.

However, data from third quarter and first nine months of the fiscal year show that Bank Asia, United Commercial Bank, Southeast Bank and IFIC Bank performed well compared to the same time last year.

Bankers attributed the erosion in profit to new loan classification and rescheduling rules by the central bank and the presiding anti-business climate in the run-up to national elections.

“Increased loan-loss provisions based on the central bank’s new rules have eroded our profits,” MA Mannan, managing director of Islami Bank, told The Daily Star.

Islami Bank had to set aside more than Tk 500 crore from its nine months’ profits to provision against possible loan losses.

“We are feeling extreme pressures at the moment, but things may improve in the next quarter,” said Mannan.

Despite good business in the third quarter this year, the nine months’ profit figure for Jamuna Bank brought down its earnings per share to Tk 0.59 from Tk 1.73 at this time a year ago.

“Our business growth was excellent in the third quarter, but we had to make provisions for some bad loans in past years,” Shafiqul Alam, managing director of Jamuna Bank, said.

Alam said his banks’ provisioning requirement doubled to Tk 100 crore for the nine months this year from Tk 50 crore in the corresponding period a year ago.

The nine-month net profit for EBL also witnessed a sharp fall to Tk 104 crore this year from Tk 123 crore a year ago. For the third quarter, the bank’s net profit stood at Tk 6.56 crore and earnings per share at Tk 0.11 against Tk 34.42 crore and Tk 0.56 respectively for the same period last year.

“Overall, the banking sector is not in a good condition. Non-performing loans have been increasing and may be, banks will not be able to give good dividends for this year,” said Ali Reza Iftekhar, managing director of EBL.

News:The Daily Star/02-Nov-2013

Comments