Banks' soured loans finally shrink

Banks' default loans dropped 12.45 percent in the last quarter of 2014 after rising in the three previous quarters, much to the relief of the central bank.

On December 31 last year, the banking sector's bad loans stood at Tk 50,155 crore or 9.69 percent of its total lending.

In contrast, on September 30, the sector's bad loans were Tk 57,291 crore or 12.6 percent of the total outstanding loans.

The sector started the year with Tk 40,583 crore of bad loans, which then rose to Tk 48,172 crore in the first quarter, Tk 51,345 crore in the second quarter and further more the following quarter.

The upward trend prompted the central bank towards the end of last year to direct the banks to take strong measures to address the situation.

Subsequently, banks went on strong recovery drives in the last quarter and also conducted rescheduling and write-offs, Bangladesh Bank Deputy Governor SK Sur Chowdhury said.

The banks realised Tk 3,064 crore in the fourth quarter of 2014, which is up almost 45 percent over the previous quarter.

The central bank too had a part in the drop in classified loans: it intensified its monitoring of the banks' default loan situation, pushed banks to pay more attention to realising loans and put pressure on them to create a good lending culture in the country, Chowdhury said.

“Plus, the political situation was calm last year, so the businessmen could pay the loans on time.”

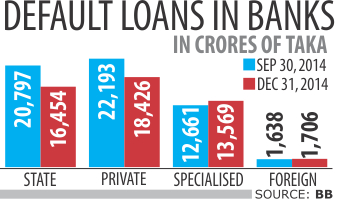

Between September and December, the bad loans of the four state-owned commercial banks plummeted 20.88 percent and private banks 16.97 percent.

The five specialised banks though saw their bad loans swell 7.17 percent during the period. The foreign banks' bad loans too increased, by 4.15 percent.

The central bank, in a statement, tipped the classified loans to shrink further in the coming quarters once the large loan restructuring policy comes into effect

News:The Daily Star/10-Feb-2015

Comments