Bangladesh Bank yesterday put a cap on the US dollar at inter-bank exchange rate plus Tk 2, to control the recent volatile market, said bankers.

The central bank informed the treasury officials of the commercial banks about the ceiling at a meeting yesterday.

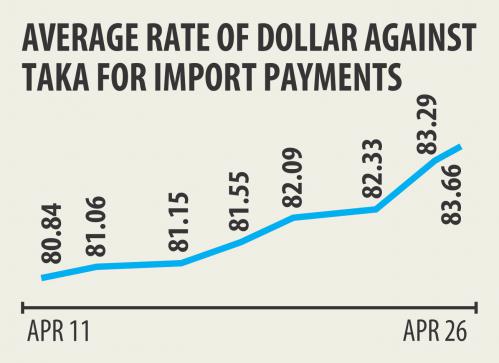

The average Bills for Collection (BC) selling rate crept up 3.49 percent to Tk 83.66 against the dollar in just two weeks since April 11, according to data from Bangladesh Foreign Exchange Dealers' Association (BAFEDA). Banks use this rate to sell dollars to importers.

Citibank NA and Standard Chartered Bank quoted the BC selling rate of a dollar at a highest of Tk 84.80 yesterday.

Some other banks quoted the rate at Tk 84 or more for a dollar yesterday and the rate went up to Tk 84.65 for remittance payments, said bankers.

“The central bank has asked us to cap the dollar price at the inter-bank rate plus Tk 2. We hope the exchange rate will come down today,” said a senior treasury official of a private bank who attended the meeting.

The inter-bank exchange rate was Tk 80.1 for a dollar yesterday. So, banks would have quoted the exchange rate for import payments at Tk 82.1.

The central bank will inject dollars into the market today to stabilise it, said another treasury official of a private bank.

The average BC selling rate was Tk 80.84 a dollar on April 11, which rose to Tk 83.66 yesterday, shows data from BAFEDA.

Though a weak taka against the dollar cheers remitters and exporters, it makes imports costlier, which might raise prices of commodities ahead of Ramadan next month. Letters of credit worth over $4.3 billion were opened for imports in March, which is a growth of 21 percent year-on-year, shows BB data.

According to bankers, imports continued to grow in April as well for the upcoming month of Ramadan. The pressure for payments also played a role in appreciation of the dollar rate, said treasury officials.

“We asked the treasury officials to be rational. If the import cost rises, consumers will be affected during Ramadan,” said a senior BB official, who was present at the meeting.

He also hinted at BB's intervention in the market to stabilise the exchange rate.

“We are scrutinising whether any bank is trying to benefit from the present market,” he said, requesting anonymity.

news:daily star/27-apr-2017

Comments