BB revs up fight against inflation

Bangladesh Bank (BB) yesterday increased repo and reverse repo rates by 0.5 percentage points to slow credit growth in a bid to contain inflation.

The new move came a day after the central bank lifted the lending cap. Executives of commercial banks and a former governor of the central bank have backed the move.

The central bank increased the interest rate on repo to 6 percent, which was 5.5 percent earlier.

The repo rate is the interest rate at which the central bank lends money to commercial banks. The reverse repo rate is the return banks earn on excess funds parked with the central bank.

The rate of interest on reverse repo was hiked by 0.5 percentage points to 4 percent. A central bank circular said the new rates of interest will come into effect from Sunday.

On Sunday the BB withdrew 13 percent lending cap on the rate of interest on credit.

The bankers said the moves will make credit costlier. In January the BB in its Monetary Policy Statement (MPS) indicated repeatedly that it will hike the policy interest rate to contain inflation.

The MPS said: "All central banks in our immediate neighbours and in the fast growing emerging economies of the East Asia are acting decisively to curb inflationary pressure from excessive monetary expansion, with repeated rounds of hikes in both policy interest rates and Cash Reserve Requirement (CRR)".

The MPS also said the recent rates of growth in the credit to the private sector are high and well out of line with likely growth trend in nominal GDP (gross domestic products).

It said, getting to a firmer grip on monetary expansion is an unavoidable necessity.

In the recent times, inflation is rising in almost every month. In January, alongside food inflation, non-food inflation started going up, ringing an alarm bell in the BB.

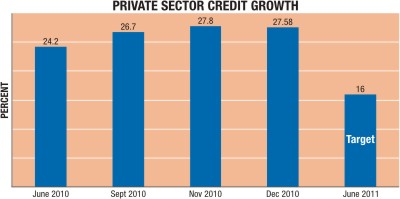

In July last year, in the first MPS of the current fiscal year, the BB set a target of cutting down private sector credit growth to 16 percent by June next from 24 percent in June. But instead of coming down, the credit flow went up every month and in December the private sector credit growth stood at 27.58 percent.

Earlier the BB increased repo rate in September last year, and in December it hiked CRR to bring down the rate of credit growth.

Association of Banks, Bangladesh President K Mahmud Sattar said, after the central bank gave a contractionary signal in the market, the repo rate had to be increased. He said the withdrawal of the lending rate cap is a good decision on the part of the central bank.

Former BB governor Salehuddin Ahmed said the BB will have to remain alert so that the banks after borrowing through repo do not use the money in unproductive sector.

Source: The Daily Star/March 11, 2011

Comments