State banks continue to rely on handouts

The government provided Tk 11,219 crore to four state banks over the last 12 years to meet their capital deficits but the lenders' financial position is yet to improve.

This fiscal year too, Tk 5,000 crore has been earmarked in the budget for injection to Sonali, Janata, Agrani and Rupali banks to meet their capital shortfall. Owing to poor management, the banks accrued a cumulative loss of Tk 10,112 crore over the past seven years, according to central bank statistics.

In other words, the government is doling out handouts from the public exchequer for the four banks, let alone get any dividends from them.

In a meeting with the chairmen and managing directors of the banks, Bangladesh Bank Governor Atiur Rahman expressed serious dissatisfaction over their first quarter performance.

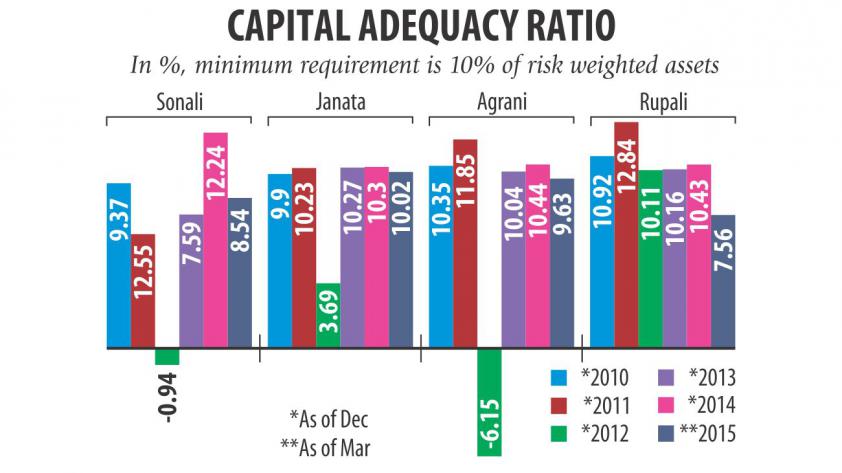

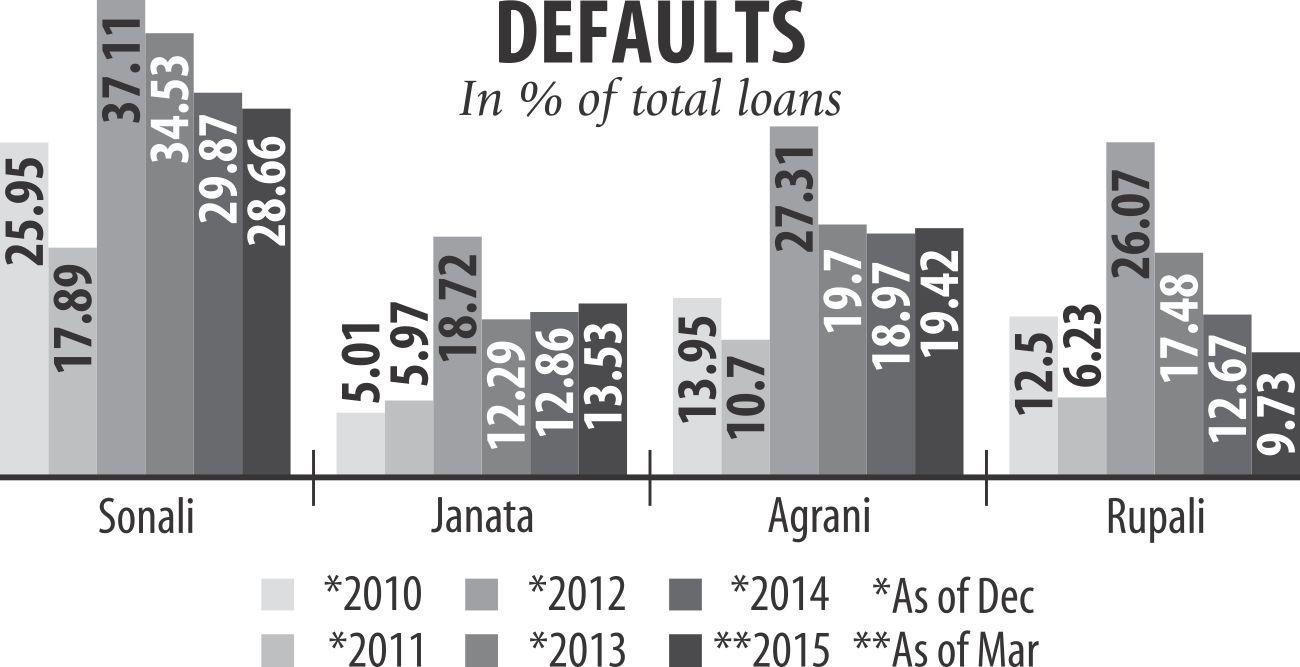

The state banks deteriorated the most in 2012 in terms of capital and default loans. The situation improved slightly in 2013 and 2014 but during the January-March period of this year, it again took a turn for the worse, much to the chagrin of the governor.

Rahman has become so annoyed with the four banks that he even threatened that their managing directors would be removed if the situation did not improve, said a high official of Sonali Bank who was present in the meeting.

The governor also said the central bank would not hesitate to appoint observers and write to the government about the poor performance of the boards.

In 2012, at least two banks' capital adequacy ratio (CAR) became negative, and that of the other two dropped to almost half of the required capital.

At the same time the default loan of the banks also increased up to 37 percent.

In 2013, the government provided Tk 4,100 crore to four state banks to improve their capital position to some extent. Of the amount, Tk 710 crore went to Sonali alone.

The banks are required to maintain a minimum capital of 10 percent of their risk-weighted assets. But in March the CAR of Sonali, Agrani and Rupali fell short of their required ratio. In the January-March quarter, the default loans of the banks increased, which resulted in a decline of their income and their CAR.

The return on asset (ROA), which shows how much the bank earns against Tk 100 investment after deducting its expense, dropped to 0.04 percent at Sonali, 0.09 percent at Janata, 0.17 percent at Agrani and 0.13 percent at Rupali in March. It was 0.65 percent at Sonali, 0.61 percent at Janata, 0.4 percent at Agrani and 0.16 percent at Rupali in December 2014.

Though the four banks' income fell, their expense remained close to their quarterly target.

Sonali spent 20.21 percent of its yearly target, Janata 19.93 percent, Agrani 22.46 percent and Rupali 24.29 percent. Bankers said the condition of the banks started deteriorating in 2009 after the government started to appoint too many people in their boards on political consideration, creating grounds for a number of financial scams in recent years.

But from 2013, the government started exercising caution, so the situation is bound to improve, said a senior official of the Banking Division.

Also this year, in an effort to improve the situation further, the finance ministry division signed performance agreements with the boards of the four banks, he said.

Agrani Bank Chairman Zaid Bakht said no big felonies such as those involving Hall-Mark Group are now taking place at state banks. “It's all in the past.”

It is not just Agrani, the three other state banks too are disbursing loans cautiously, he said, adding that in many instances, the bank officials are over-cautious.

Bakht said the monitoring by the central bank has also intensified. A Sonali high official said once a loan becomes bad it is very difficult to realise it.

Still, some loans are being given and rescheduled under political influence. There are occasions when borrowers request the banks to send the rescheduling proposals to the central bank when they are not covered by the rules.

They went on to get consent from the BB and enjoy the facility. The realisation of loans is being delayed due to pending cases, according to bankers.

As of March 31, the four state banks had 16,590 pending cases involving Tk 21,934 crore.

In the recent meeting, the BB governor also said the picture of the banks' financial condition is not pleasing at all.

Default loans and capital deficits are the major problems facing the banks. The other problems include: high-operating costs; poor efficiency; and weakness in corporate governance, risk management, internal audit and asset, and liability management.

Rahman said assets would continue to erode until their quality improved.

News:The Daily Star/16-Aug-2015Other Posts

- AKM Saifuddin Ahamed of Deputy Managing Director of Jamuna Bank Ltd and Yeamin Sharif Chowdhury, Head of Buisness, Transcom Electronics sign an agreement at the bank's head office on Saturday. Under this agreement all the employees of the bank and JBL cre

- EXIM Bank

- IDB to set up country office in Dhaka

- Nine banks agree to pay $2b to settle forex rigging suit

Comments