Stocks return to the red again

Stocks returned to the red again after meagre improvement in the previous week as ongoing downtrend and subsequent fear of unknown bottom is still puzzling the investors to come out of the 'wait-and-see policy'.

Stocks returned to the red again after meagre improvement in the previous week as ongoing downtrend and subsequent fear of unknown bottom is still puzzling the investors to come out of the 'wait-and-see policy'.

The market witnessed five trading sessions as usual. Among those, four sessions lost 150.72 points while one session gained 6.39 points.

Week-on-week, the prime index of the Dhaka Stock Exchange, DGEN, plunged 144.33 points or 3.43 per cent to close at 4,066.25.

The all share price index DSI went down by 120.09 points or 3.37 per cent to end at 3,440.01. The blue-chip index DSE-20 also lost 96.47 points or 2.82 per cent to close at 3,319.69.

The Chittagong Stock Exchange also declined with the CSE Selective Category Index falling by 265.48 points or 3.24 per cent to close at 7,901.52.

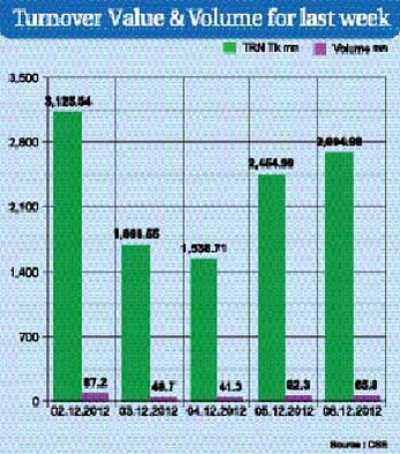

"Addition of a new listing barely helped the market to recover. There was only one positive session during the entire week. Average volume and turnover continued to decline amid poor participation of investors," commented LankaBangla Securities in its weekly market analysis.

"During the week, World Bank's visit regarding Padma Bridge financing issue failed to create positive sentiment, while in earlier months, the investors overreacted to the issue as the bourse was responding quicker to come out of the illusion of knowledge and resulting impulse trading, especially in the current downtrend," the IDLC Investments said in its weekly market analysis.

In the midway of the week, 'hartal day' made the market slow as hartal sentiment influenced the market pulse. As a result, the investors were not keen to participate and turnover hit the five months' low, the IDLC analysis said.

The investors adopted a 'wait-and-see policy' amid increase of political violence. However, Generation Next Fashions created buzz which gained by 335 per cent and occupied 15.52 per cent of total trade on debut trading session, it added.

Week closed over falling sentiment. News of gloomy outlook over much wanted Padma Bridge financing by World Bank scared the market. However, it had not affected the market like before. Fear of unknown bottom of ongoing downtrend is still puzzling investors to come out of the 'wait-and-see policy', it added.

News: The Daily Financial Express/Bangladesh/8th-Dec-12

Other Posts

- Mercantile Bank opens branch in Gaibandha

- Krishak Card: A new generation banking product

- Greed-based lending should be replaced with a need-based one

- Will Kim be successful to change World Bank as a 'solution bank'

- ADB cuts Asia growth forecasts on India’s slowdown

- Dubai banking sector reinvents itself

- Padma Bridge work to start without further delayWB official assures

- Austrian central bank slashes growth forecasts

Comments