Finance

Malaysia works on free trade deal with Bangladesh

The Malaysian government is working on proposed free trade agreement with Bangladesh to boost bi-lateral trade between the two countries, said Malaysian High Commissioner (HC) in Bangladesh.

“We’ve completed the free trade agreements with India and Pakistan. We want to do the same with Bangladesh. We are now working on details of the agreement,” Norlin Othman, the High Commissioner said in an exclusive interview with BSS.

Bangladesh exported products worth $43.87 million to Malaysia while imported goods valued at $1,759.60 million in 2010-11 fiscal year from them.

Bangladesh exports to Malaysia include foodstuff, jute goods and apparels and imports primarily involve machinery and electronics goods.

Othman said Malaysia has initiated the proposal to sign a free trade agreement, which would come into effect after both sides agree on it. “It took two years to finalise an agreement with India, but I am optimistic it would not take too much time for a similar deal with Bangladesh.” “The proposed agreement is now at the discussion level. It will be signed once both sides reach a consensus on it.

So, let the two sides work complementary to each other. We must follow the rules of World Trade Organization (WTO) to finalise the deal,” said the diplomat.

Asked about the bilateral trade that is heavily tilted in favour of Malaysia, she said, “Of course there is a trade gap, but Bangladesh has huge potential to increase its export to Malaysia.”

She said Malaysia with 28 million people does not require lot of food or garment products, but it needs some high-end products which Bangladesh can supply and thus expand its market share.

The HC, however, said although Bangladesh’s export to Malaysia is lower in volume, the services Bangladesh providing to Malaysia is higher.

“What Malaysia is encouraging is that either you increase your volume of exports or produce products that Malaysia needs. I think it will help reduce Dhaka-Kuala Lumpur trade gap,” said the Malaysian HC.

Othman said a good number of Bangladeshi entrepreneurs are doing business with Malaysian enterprises in service sector including restaurants, small shops and furniture factories.

On the other hand, she said, many Malaysian entrepreneurs are working in high-tech industries including issuing machine readable passport (MRP) and setting up small independent power plants in Bangladesh.

“Therefore, we are contributing to the economies of the two countries. But, the fact is that this is not receiving publicity as it should be,” she pointed out.

News: The Daily Independent/Bangladesh/21th-Oct-12

Rupee plunges to 1-mth low on heavy dollar demand

Mumbai: The rupee Friday fell by a whopping 43 paise to close at one-month low of 53.84 on the back of heavy dollar demand from oil importers and defence companies, extending losses for the second straight day.

Mumbai: The rupee Friday fell by a whopping 43 paise to close at one-month low of 53.84 on the back of heavy dollar demand from oil importers and defence companies, extending losses for the second straight day.

A firm dollar overseas against the Euro increased pressure on the rupee sentiment, while FII inflows worth Rs 80 crore could not help rupee recover from lows, forex dealers said.

The rupee commenced remarkably lower at 53.70 a dollar from last close of 53.41 at the Interbank Foreign Exchange (Forex) market and immediately touched a high of 53.58.

However, persistent dollar demand from importers, mainly from oil refiners, and defence companies amid weakness in local stocks put pressure on the rupee.

“There was significant dollar demand as the US currency gained strength in the global market,” said Ashutosh Raina, chief dealer at HDFC Bank.

It fell back to a low of 53.99, before concluding slightly better at 53.84 -- a fall of 43 paise or 0.80 per cent. Friday, it had tumbled by 54 paise or 1.02 per cent.

The rupee had last ended at 54.38 on September 20.

“There was dollar demand from defence-related companies Saturday but the quantum is not immediately known. It was one of factors why rupee slumped so much Saturday,” said a treasury head of a state-run bank.

The rupee after closing at a recent high of 51.74 on October 4, appears to have lost steam and is seen fast approaching the 54-mark as FII inflows have slowed.

The dollar index, a gauge of six major global currencies, was up by 0.11 per cent, as the first day of a summit meeting of European Union leaders produced no surprise, said global analysts.

For the week ended October 19, the rupee was down nearly 2 per cent—its biggest weekly loss in about 4 months

News: The Daily Sun/Bangladesh/21th-Oct-12

NBR logs Tk 428cr tax from fair

Tax receipts counted in four days of the weeklong income tax fair have exceeded the National Board of Revenue's total collection from last year's fair.

NBR collected Tk 428 crore in tax, compared to last year's total collection of Tk 414 crore, the tax authority said in a statement yesterday.

The NBR fair last year took place in seven divisional cities.

The increase in revenue can be attributed to the huge turnout of taxpayers and the launch of the fair in 11 districts along with the seven division cities.

“Taxpayers' crowd continued for the fourth day. They came to use various services, including getting new TIN (taxpayer identification number) and submitting tax returns," the NBR said.

Some 40,562 taxpayers submitted returns at the fair and 7,262 received TINs. The program remains open from 10am to 5pm.

Last year, 62,272 people submitted returns and 10,041 new TINs were issued.

The fair began on September 16, adding Mymensingh, Gazipur, Faridpur, Comilla, Noakhali, Jessore, Kushtia, Patuakhali, Bogra, Pabna and Dinajpur to its coverage along with the seven divisional cities.

The Officers' Club venue in Dhaka helped the tax collector secure Tk 402 crore out of Tk 428 crore with 22,447 returns being submitted.

The fair, the third of its kind, will end on September 22 in divisional cities and on September 20 in the districts.

The NBR has opened 36 booths to receive tax returns, 16 booths for TIN issuance and 20 "help desks" to inform taxpayers about their tax payment circles and other details at Officers' Club.

Sonali and Janata banks also have eight booths to facilitate direct tax deposits. The tax authority has also opened a designated corner for e-payment to let people know about procedures of paying tax online.

News: The Daily Star/Bangladesh/20-Sep-12

Forex reserve crosses $11b

The country's foreign currency reserves yesterday crossed $11 billion thanks to slowing imports and steady remittance growth, officials said.

The foreign currency reserves went down below $11 billion last week when the country paid $70 million to Asian Clearing Union as debt servicing.

A central bank official said the reserves stood at $11.1 billion now and the banking regulator hopes to cross $12 billion in the next two to three months.

The steady flow of remittance and declining imports contributed to the rise in reserves.

Non-resident Bang-ladeshis send $1.167 billion in remittance in August, up by 6 percent over the same month last year.

This is the ninth consecutive month that Bangladesh has received over one billion dollar in remittance.

The remittance in the first two months of 2012-13 rose by 11.9 percent over the same period a year ago.

News: The Daily Star/Bangladesh/13-Sep-12

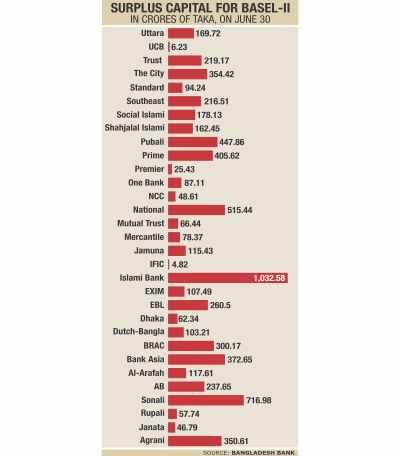

Banks' surplus capital at adequate levels

The surplus capital in banks stands at Tk 4,218 crore, setting them at good stead for the Basel III preparations starting next year.

Of the country's 47 banks, all except five have surplus capital as per the international Basel II standards, which stipulate, as a rule of thumb, a capital base of 10 percent of the bank's liabilities.

As of June 30, the banks had a total capital of Tk 56,201 crore, whereas the capital requirement was Tk 51,983 crore, according to central bank statistics.

Of the 30 private commercial banks, three have a capital deficit: Bangladesh Commerce Bank of Tk 177 crore, First Security Islami of Tk 136 crore and ICB Islami Bank of Tk 1,192 crore.

Of the specialised banks, Krishi Bank and Rajshahi Krishi Unnayan had capital deficits -- of Tk 4,100 crore and Tk 359 crore respectively.

“Most of the commercial banks do not have capital deficits,” said a central bank official, asking not to be named.

“The few who do are problematic banks to begin with. Various measures are being taken to improve their capital adequacy.”

From 2015, the banks will have to maintain capital as per Basel III requirements, preparation of which will start next year, the official added.

The Basel Committee, named after the city of Basel in Switzerland, consists of central banks of 27 countries, including India, and sets the international standard for capital requirement.

“Globally the preparation for capital requirement as per Basel III has already started, but in Bangladesh it will start in the beginning of next year,” said Helal Ahmed Chowdhury, vice chairman of the Association of Bankers Bangladesh.

“The global financial of 2007-08 has compelled the Basel III to incorporate many risk factors in setting the capital requirements,” said Chowdhury, also the managing director of Pubali Bank.

Given the rise in loan defaults in Bangladesh, Bangladeshi banks would face many challenges to meet the Basel III requirements, he thinks.

“However, as per the Bangladesh Bank guidance most of the banks do not have any capital deficit. As a result, most of the banks will be able to maintain their capital to Basel III standards,” said a hopeful Chowdhury.

News: The Daily Star/Bangladesh/09-Sep-12