Sticky

Banks asked to ensure governance as report spots weaknesses

Bangladesh Bank Governor Atiur Rahman on Sunday expressed dissatisfaction over the credit scams revealed recently as he unveiled the latest financial stability report.

He accused some banks of not following the realistic application of the central bank guidelines that caused deterioration in classified loan status of the worst five banks.

“The overall banking sector remained stable,” he said, upon unveiling the Financial Stability Report 2012 at Bangladesh Bank headquarters in Dhaka.

Atiur said no disaster had taken place in the banking sector until now with no red flags popping up either. As a result, a base of historical stability had been established.

“We have to give highest priority to ensure the corporate governance of banks, including state-owned ones to maintain stability in the financial sector,” he said. “Bangladesh Bank issued a guideline detailing instructions regarding this, but the scenario of realistic application is not absolutely reassuring.”

To bring back a more assuring situation to establish corporate governance, member of directors in the banks’ boards needed appropriate attention, he said. Bangladesh Bank will provide all kinds of support in this regard.

“Sharp price correction in the stock market and several fund forgery has affected the banking sector negatively,” said Bangladesh Bank Deputy Governor SK Sur Chowdhury. In addition to classified loans being increased because of the central bank’s strengthened policy and aggressive lending tendency of the banks.

So central bank has planned to strengthen the supervision to restore discipline in this sector, he said.

According to the financial stability report, the classified loans of the banking sector recorded a moderate rise at end-December 2012 compared to end-December 2011, which could largely be attributed to the new stricter loan classification and provisioning regulations of the central bank.

Classified loan concentration ratios of the 5 worst banks and 10 worst banks were 62.7% and 73.2% respectively at end-December 2012. Almost two-thirds of the classified loans are concentrated in three state-owned commercial banks and two state-owned specialised development banks.

The classified loans in the state-owned commercial banks are higher due to lack of efficiency in fund management, extending obligatory financing towards social and economic priority sectors and politically motivated lending.

The non-performing loans to total loans ratio has increased to 10% in FY12 from 6.2% in FY11. More than two-thirds of the total non-performing loan of Tk285bn is bad or loss.

News:Dhaka Tribune Bangladesh/17-Sep-2013Lending rate cut begins due to slump in banking business

Jebun Nesa Alo

The country’s commercial banks have begun reducing their lending rates thanks to excess liquidity in the money market and a central bank move to rationalise the interest rate spread (the difference between the average lending and deposit rates).

Some banks have already reduced their rates on loans and advances this month although this has not yet been announced officially, bankers said. Their announcements will be made in December while other banks are now at the planning stage.

The banks are reducing the lending rate to help increase the banks’ loans and advances while bringing the spread down to within the desired level, they said.

Having a huge amount of idle money accumulated due to poor demand for loans, the commercial banks earlier went for a heavy cut on the deposit rates, pushing up the spread above the desired level of 5%.

This prompted Bangladesh Bank to ask the commercial banks to cut the lending rate, said a senior executive of the central bank who recently expressed concern over banks crossing the threshold, especially Brac Bank and a number of foreign banks.

“The spread increased mainly due to lower deposit rates that came down due to a slump in banks’ business. The lending rates remained unchanged, on the other hand,” said Association of Bankers Bangladesh (ABB) President Nurul Amin.

He said the spread climbed since the beginning of this year. Barring a few exceptions, the average spread is not so alarming, he added. Bangladesh Bank data shows that the average spread was 4.91% in April, 2011 and that this has increased gradually to stand at 5.23% in July.

“Banks are going to cut lending rates individually from this month and might give announcements in December,’’ said the bankers’ president.

The average annual lending rate of the private banks stood at 14.36% and the deposit rate at 9.13% as of July down from the prvious month's rates of 14.44% and 9.1% respectively.

The spread of 26 banks remained above 5% as of July as per the latest Bangladesh Bank data. The spread of foreign banks averaged at 8.64% and among the private commercial banks, Brac bank’s spread was highest at 9.26%.

“The average spread crossed 5% despite the central bank’s directive to bring down the gap to the level below 5%,” Bangladesh Bank Deputy Governor SK Sur Chowdhury said.

To do so, the central bank asked the banks to cut down the lending rate. It already warned 26 banks about crossing the limit.

The interbank call money rate remained stable at a range of between 7% and 7.5%, showing signs of adequate liquidity in the money market.

The call money rate came down to its lowest at 7% in last couple of weeks, and went as high as 8% in the last year. It, however, rose to 9% for just over one week ahead of Eid-ul Fitre.

“Banks should cut the lending rate now as the deposit rate has already been reduced. The lending rates of some banks, however, decreased slightly,” said Bangladesh Bank Chief Economist Hasan Zaman.

“The spread widened because of increasing non-performing loans (NPLs),” said Pubali Bank Managing Director Helal Ahmed Chowdhury. “It would come under control as the banks already started cutting down the lending rate from this month and signs are there that the political turmoil will ease.”

The ratio of NPLs to the total loans for the banking sector, in both gross and net terms, increased at the end of third quarter of FY13 compared to the second quarter, as per BB data.

Gross NPLs went up from 10% at the end of second quarter to 11.9% at the end of the third quarter. The overall banking industry NPL was 2.6% higher at the end of the third quarter of FY13 than the last five years' average of 9.3%.

News:Dhaka Tribune/14-Sep-2013

Finance firms top taxpayers’ list

Sohel Parvez

Financial sector entities and energy companies dominate the list of top 10 taxpaying firms that would be receiving “tax cards” from the National Board of Revenue next week.

The cards, to remain valid for one year, will be given for fiscal 2010-11 and fiscal 2011-12.

“We are providing the tax cards to encourage people to become tax compliant and help the government increase the amount of direct tax needed to finance the annual budget,” an NBR official said.

Of the 10 firms to receive the tax cards for fiscal 2011-12, five are from the financial sector — three banks, one life insurance company and one linked with the stockmarket — three from the energy sector and two from the manufacturing sector.

The financial sector entities had dominated the award list for fiscal 2010-11 as well: the list consists of six firms from the banking and finance sector, to be rounded off by firms from the energy and manufacturing sectors.

Well-known conglomerates, however, remained out of the lists, largely because of tax-related disputes, the official added.

From the companies, chairman and managing director of a firm will get the tax cards.

Together with the corporates, the revenue authority is set to honour 10 individuals with tax cards as well for their contributions to the state coffer, at the ceremony on September 15 marking the Income Tax Day.

The NBR has been observing the Income Tax Day since 2008 to motivate the people of a country rife with tax-dodging and non-compliance into paying taxes regularly.

At present, less than 1 percent of the 15.36 crore population pay taxes. The revenue authority thinks the number should be higher, given that the country has been experiencing steady economic growth, rising income and growing middle-class.

Also, the tax authority will honour taxpayers from district and city corporation levels in two categories — Longtime and Top taxpayers. Two longtime and three top taxpayers in each district or city corporation would be awarded for fiscal 2012-13.

The official said the companies were selected due to not having any default loan, income tax and VAT (value-added tax) related disputes in court. The firms paid taxes upwards of Tk 100 crore in each of the two years, he said.

Tax card winners will get some privileges including priority to reserve seats in the state-run airline, trains and water transport. The tax card holders will also be able to use the Commercially Important Person lounge at airports, according to the policy framed in 2011.

News:Thy Daily Star/14-Sep-2013

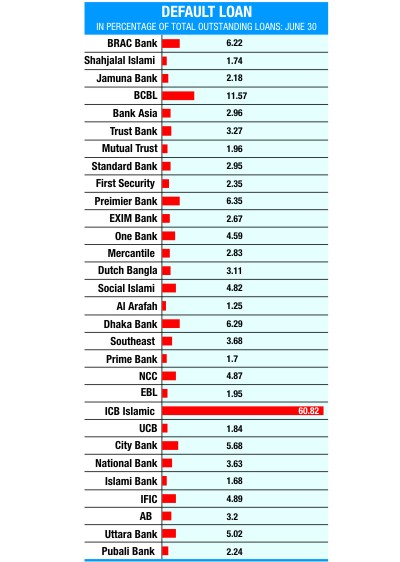

Default loans on the rise

Default loans continued to rise in the second quarter -- by Tk 643 crore or 2.66 percent -- due to sluggish activities in the industrial sector and unhealthy competition among some private banks.

On June 30, banks recorded default loans of Tk 24,384 crore of their outstanding loans, up from Tk 23,752 crore on March 30, according to Bangladesh Bank statistics.

In the first quarter to March, default loans rose by Tk 1,043 crore or 4.59 percent.

In percentage, however, default loans went down slightly because of a rise in outstanding loans.

On June 30, the total amount of default loans was 7.14 percent of their outstanding loans -- down from 7.27 percent in March.

Default loans of all private commercial banks, state-owned commercial banks and foreign commercial banks increased, except for the specialised banks, but the rise was the highest among the private banks.

However, default loans of all the private banks, except two, were low -- below 5 percent.

In June, default loans of the state banks rose by Tk 125 crore compared to March, according to the central bank statistics. Such loans in state banks increased by Tk 592 crore and in the foreign banks by Tk 37 crore.

But default loans of the specialised banks went down by Tk 124 crore during the same period compared to that in March.

Krishi Bank Chairman Khondker Ibrahim Khaled said performance in the manufacturing and housing sectors slowed, which trapped the loans in these sectors.

He also said money of some banks, especially of the private ones, got stuck in the stockmarket after a fall in prices there. He said another reason for a rise in default loans may be the weakness of the banks in monitoring the loan recovery activities.

Due to an unhealthy competition, some banks do not put adequate efforts to realise default loans from some parties.

A senior executive of a private bank supported the views of Khaled, and said many customers do not pay loans timely and the banks concerned also do not put any pressure on them.

Khaled also said, in this context, if the BB approves some more new banks to be set up the unhealthy competition will rise. He said, instead of giving approval to new banks the central bank should intensify monitoring of the existing banks.

News: Daily Sun/ Bangladesh/ Aug-17-2011

CIB report goes online

The Central Bank advanced one step forward towards its automation process as the Governor Dr Atiur Rahman formally launched the online Credit Information Bureau (CIB) reports on Tuesday.

The system will reduce the whole report processing time to only few clicks of computers from around seven valuable working days, along with ensuring transparency and keeping loan defaulters away from getting fresh loans through any loopholes, BB officials hoped.

Banks and financial institutions will now be able to access the CIB database online to get the credit report of the concerned borrower. The database will consist of detailed information of individual borrowers, owners and guarantors.

CIB report, the dynamic and hassle-free system, is considered a pivotal component of risk management measures.

Online CIB will minimise the extent of default loan by facilitating the banks and financial institutions with credit reports of the loan applicants very quickly, and therefore, lending institutions would not encounter any credit risk while extending lending or rescheduling facility, the BB Governor said. “The CIB online service will play a pivotal role in creating a disciplined environment for borrowing. Risk management will be more effective as it’s an improved and efficient system,” Atiur said.

He also hoped that the system will assist the election commission in finding out the loan status of the candidates competing in national and local elections, apart from increasing banks’ expertise.

Currently, the number of borrowers in the country is more than 9.2 million and the BB daily receives around 6,000 applications for CIB reports.

Though only five days were stipulated for every procession, BB officials sweltered to do the job even in 20-25 days for shortage of manpower and manual handling.

But the introduction of the online system will reduce their work pressure and they will be able to utilise their skills elsewhere as the time consumption to get the job done will come down to only five minutes.

News: Daily Sun/ Bangladesh/20-july-2011