Sticky

BB probes charges against 11 banks Investing in share market

The Bangladesh Bank (BB) has identified 11 commercial banks for responsible in stock markers volatility that led market to historic fall.

Three separate teams of the central bank have already found involve-ment of these banks after primary investigation, a senior official of the BB said.

“One of the commercial banks made profit of Tk 10.40 billion during last year. Of these amount of profit, Tk 4.40 billion came during the last month by investing in share market,” he said without disclosing the name of the bank.

He also said allegations have been found that bank officials provided false loan to fake clients for investment in the share markets.

The BB also investigated allocation of Tk 24 billion industrial loans by a bank to its clients last year, an official of BB said.

“I am surprised how the industrial loan was invested in the industrial sector when gas and electricity connections were not given to that unit,” he said expressing his dissatisfaction.

He also said some commercial banks on an average borrowed Tk 70 billion during share market debacle and invested in share market illegally.

Even some banks have invested over 10 percent of their capital violating BB guidelines, he said.

Source: Daily Sun/Bangladesh/14 Jan 2011

Banks Start Electronic Fund Transfer on Feb 24

Banks of Bangladesh will introduce an electronic fund transfer system on February 24 to speed up transactions and payment, the central bank said yesterday. The system will be introduced under the central bank's automated clearinghouse project. With the automation, the corporate entities will be able to make faster payment of salaries to employees and make refund warrants in the case of initial public offerings and company dividends.

It will also take remittance and various government allowances such as those for freedom fighters, widows and elderly, easily to the beneficiaries. People will also be able to use the system to pay utility bills quickly. The decision was taken at a meeting of chief executives of all commercial banks at the central bank premises. Governor Atiur Rahman presided over the meeting.

Bangladesh Bank launched the automated system for settlement of paper cheques on October 7 last year. The meeting also decided to settle high-value cheques -- Tk 5 lakh or more -- from January 31 at 1,200 bank branches in Dhaka region. Besides, all cheques in Sylhet region will come under automated clearing system from January 20 and the Chittagong region from February 3. BB chief urged the banks to take technical preparations for the sake of modernising the payment system. He underscored cooperation among banks.

Rahman directed state-run banks to take special steps quickly to this effect to survive in the competition.

News: The Daily Star Bangladesh/05 Jan 2011

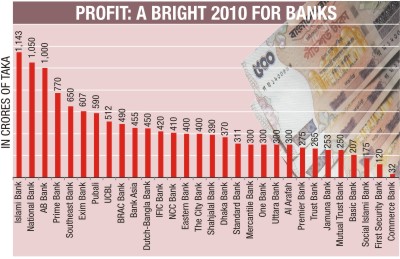

Banks log hefty profit

Private banks logged as high as 90 percent growth in their operating profit last year, riding on a boom in stockmarket and an upward trend in external business.

Most banks marked a rise in profit, ranging from 50 percent to 90 percent, and a few posted more than Tk 1,000 crore profit.

On the last day of 2010, Friday, they sat to count the last one year's profit. Primary data of all these 30 private banks shows that their combined profit soared by 57 percent to Tk 13,203 crore last year, against Tk 8,000 crore in 2009.

Islami Bank Bangladesh, this year also, made the highest profit at Tk 1,143 crore. Besides, National Bank and AB Bank logged more than Tk 1,000 crore each.

Managing Director of Shahjalal Islami Bank Abdur Rahman Sarker told The Daily Star that the banks are involved in the stockmarket business in different ways -- they have opened their own brokerage houses and are also doing portfolio investment. As a result, a big amount of income is accruing to them from the share market.

Sarker said the banks' income from external business also went up as the world economy shook much off the recession jitters.

Senior Executive Vice President of Mutual Trust Bank AKM Shamim said the banks' income on account of fees and commission has increased. The strict monitoring by the central bank also pulled down the banks' classified loans, increasing their income.

From January 3 to December 30, the benchmark index of Dhaka Stock Exchange went up by 3,754 points, or 82 percent, to 8,290.

Bangladesh Bank (BB) data shows that the banks' total holdings in the share market were Tk 25,000 crore as of October 31 last year.

Many banks earned a big portion of their profit from the stockmarket, bankers said. A bank involved in Islamic banking made a profit of about Tk 400 crore last year. Of the amount, Tk 100 crore came from its brokerage business.

The external trade of the banks also started going up last year, with the world economy recovering from the recession.

According to BB data, import increased by about 34 percent in July-October of the current fiscal year, against a fall of about 15 percent in the same period last year.

On the other hand, export went up by 36 percent during the July-November period of the current fiscal year, whereas the country witnessed a fall by about 7 percent in such external trade in the same period a year ago.

The banks' non-interest income increased in line with the rise in import and export.

In the first six months of the last fiscal year, the non-interest income shot up by 39 percent.

Source: The Daily Star

Rejaul Karim Byron

Rejaul Karim Byron