Sticky

Race to be delisted as loan defaulters

Jebun Nesa Alo

The loan defaulters are making serious efforts to reschedule their accounts so they do not disqualify for participating in the upcoming general election, said Bangladesh Bank sources.

As per the amended Representation of the People Order (RPO), the aspirants of the parliamentary election require clearance of default loans and outstanding utility bills.

Meanwhile, Bangladesh Bank governor Dr Atiur Rahman recently instructed the Credit Information Bureau (CIB) of the central bank to prepare related data.

A senior official of CIB told Dhaka Tribune that they are “ready logistically to provide information on loan defaults by the announcement of election schedule.”

Bangladesh Bank has seen an increase in applications for loan rescheduling recently from both the state-owned and private commercial banks, said a central bank official.

“We are following regulation in approving applications,” he added.

The banks also utilised the chance of loan rescheduling before election to recover their classified loans by receiving down-payments.

“Defaulters can regularise their loans either for short time or long time if they want to take part in the election. It is a great chance for banks to recover classified loans,” said Nurul Amin, managing director of National Credit and Commerce Bank Ltd.

“It will help reduce burden of nonperforming loans in the balance sheet.”

He said they have received many applications for rescheduling big loans for past few days particularly from business people.

However, there were no such applications that used political influence, added Nurul Amin.

Echoing with the NCC Bank MD, Pubali Bank MD Helal Ahmed Chowdhury said: “Many politicians are negotiating with us to reschedule their loans.

But it’s a great opportunity for us to recover classified loans.”

According to a Bangladesh Bank circular, no default loan can be rescheduled more than three times.

The first time rescheduling is done on payment of at least 15% of overdue instalments or 10% of total default amount, whichever is lower.

In the second rescheduling, at least 30% of overdue or 20% of total default loan – whichever is lower – will have to be paid.

The third rescheduling requires payment of at least 50% of overdue instalment or 30% of the total default loan – whichever is lower.

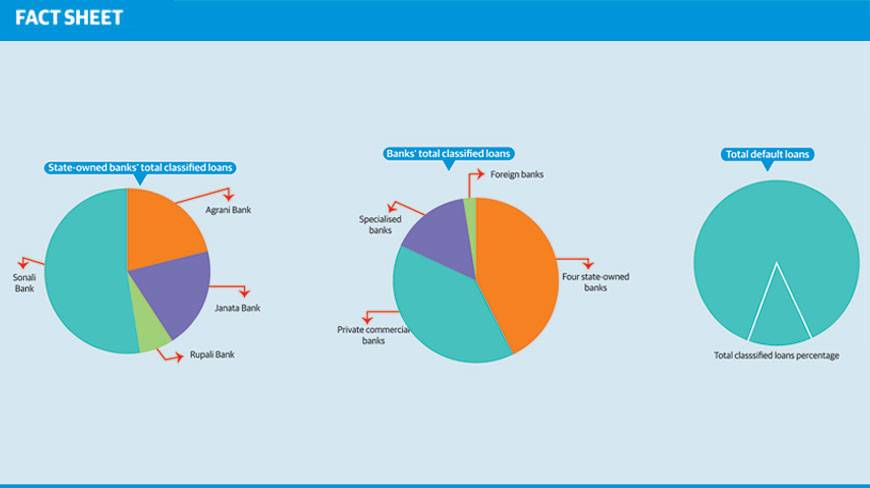

The classified loans rose 8% to Tk567bn in the July-September period quarter from Tk523bn of the previous three months, said Bangladesh Bank data.

The classified loans are about 13% of total default loans which amount to over Tk4tn.

Of the total classified loans, four state-owned banks have Tk241bn, private commercial banks Tk223bn, specialised banks Tk87bn and foreign banks Tk14bn.

Of the state-owned banks, Agrani Bank’s classified loan stood at Tk51bn, Janata Bank Tk47bn, Rupali Bank Tk16bn and Sonali Bank Tk125bn.

News:Dhaka Tribune/24-Nov-2013

New GB law shows nine directors the door

Nine female members of the Grameen Bank board have lost their posts as the parliamentary affairs ministry has published a gazette notification on the passage of the Grameen Bank Act 2013, which replaces the 1983 ordinance.

An official of the Grameen Bank said the bank would prepare for an election to the board after the Banking Division received the election rules from the ministry and in the meantime the three government members and chairman of the bank would operate the bank.

The election to the board has to be held within six months of receiving the election rules.

The law, justice and parliamentary affairs ministry on Tuesday issued the gazette notification on the new Grameen Bank law.

Tahsina Khatun, one of the nine female members of the Grameen Bank board, alleged that the government was removing them from the board “forcibly” through the new law.

“We were elected to the board of directors for up to 2015 but the government has done everything just to remove the poor women from the board,” she told the Dhaka Tribune. “It will be remembered in the history as an example of the government’s blunt intervention.”

Tahsina said the Grameen Bank board would not need the female directors as the chairman and three government-appointed members would fulfil the board’s quorum.

The Grameen Bank ordinance used to require the chairman and four members of the board to fulfil the quorum.

Parliament passed the much-talked-about Grameen Bank Act 2013 on November 5, elevating the government’s role in running the microcredit organisation without any increment of its ownership stakes. Finance Minister AMA Muhith last month said the nine “pro-Yunus” female directors of Grameen Bank would lose their positions once parliament approved the relevant bill.

News:Dhaka Tribune/21-Nov-2013

Demand for industrial loans drops amid political turmoil

Sajjadur Rahman

The disbursement of industrial term-loans continues to slide on the back of growing political unrest.

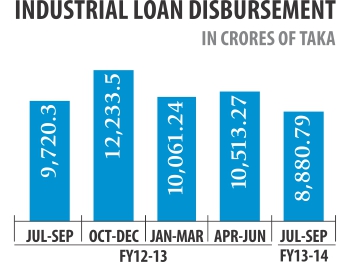

Between July and September, banks and non-bank financial institutions disbursed over Tk 8,880 crore of term loans, down 8.63 percent year-on-year and 15.53 percent from the previous quarter, according to data from Bangladesh Bank.

The disbursement of industrial term loans were Tk 10,061 crore and Tk 10,513 crore in the first and second quarters of the year respectively.

Industrial term loan includes disbursement of fresh credit, rescheduling of term loans and fund release for balancing, modernisation, rehabilitation and expansion of industrial units.

Bankers said uncertainty in the run-up to elections has acted as the biggest reason for the slowdown in industrial activities, but the tight BB policies and extra cautiousness by banks in the wake of rising fraudulence, has not helped matters either.

But Helal Ahmed Chowdhury, managing director of Pubali Bank, pointed out the recent trend of taking out low-cost loans from foreign sources and adjusting their term loans domestically, as the reason for the banks’ falling disbursement of industrial term loans.

The rising non-performing loans, of nearly 13 percent, have also squeezed many banks’ hands, he added.

“Borrowers and bankers, both are cautious as it is an election year,” said Nurul Amin, managing director of NCC Bank.

The accompanying political turmoil, together with the existing constraints of poor infrastructure and scarcity gas and electricity, has made business conditions “very tough”, he added.

The development, however, does not bode well for the country’s economy, as the industrial sector has been vital in sustaining the steady economic growth over the past one decade.

The sector’s contribution to gross domestic product (GDP) stood at 32 percent in fiscal 2012-13, in contrast to 26 percent in fiscal 2000-01 and 21 percent in fiscal 1990-91.

News:The Daily Star/22-Nov-2013

BB launches USD-BDT swap thru' offshore banking units

Siddique Islam

The central bank has introduced US dollar (USD) and Bangladesh Taka (BDT) swap arrangement through offshore banking units (OBUs) of the commercial banks, officials said.

Under the new arrangement, the banks are allowed to swap maximum $20 million from Bangladesh Bank (BB) against their BDT through their OBUs for maximum six months.

"We want to meet the growing demand for foreign currency for investment in Bangladesh through offering such facility to the banks," a BB senior official told the FE Monday.

He also said the central bank has already communicated with the banks about introduction of the USD-BDT swap facility.

"We may extend the tenure of the swap facility if necessary," the central banker explained.

The banks will receive interest on their invested BDT on the basis of reverse repo rate from Bangladesh Bank, while the banks will have to pay at the London Inter-bank Offered Rate (LIBOR) plus 1.0 per cent interest to the central bank for the US-dollar amount, according to the arrangement.

"Large foreign currency borrowers including Bangladesh Petroleum Corporation and Biman Bangladesh Airlines may take advantage of the new arrangement through borrowing from local banks," another BB official noted.

The central bank has taken the latest move against the backdrop of healthy position of the country's foreign exchange reserve in the recent times.

The country's forex reserve rose to $16.89 billion Monday from $16.85 billion on the previous working day due mainly to higher growth of export earnings and lower import payment pressure in the recent times, according to the BB officials.

"We're able to settle more than five months' import bills with the existing forex reserve," another BB official said, adding that the reserve would increase gradually in the coming days.

The deposit and lending operations of OBUs are carried out entirely in foreign currencies.

The overseas banking operations at normal bank branches are done over separate counters, by maintaining separate offshore banking accounts.

Currently, 31 local and foreign commercial banks conduct OBU operations in Bangladesh.

News:The Financial Express/20-Nov-2013

Taka weaker against UK pound, Euro

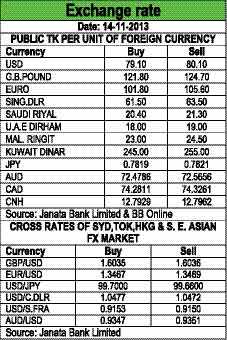

Taka became weaker against UK pound and Euro while it remained unchanged against US dollar in the inter-bank money market on Thursday. UK pound was traded between Tk 121.80 and Tk 124.70 on Thursday against Tk 120.60 and Tk 123.50 on Wednesday last. Euro was traded between Tk 101.80 and Tk 105.60 on Thursday against Tk 101.60 and Tk 105.40 on the previous day. The US dollar was traded between Tk 79.10 and Tk 80.10 on the same day.

News:Daily Sun/15-Nov-2013