Uncategorized

Fears of bear run depress stocks

Stocks opened the week with downward pressure yet again, thanks to investors' selling spree in anticipation of a bear run.

Stocks opened the week with downward pressure yet again, thanks to investors' selling spree in anticipation of a bear run.

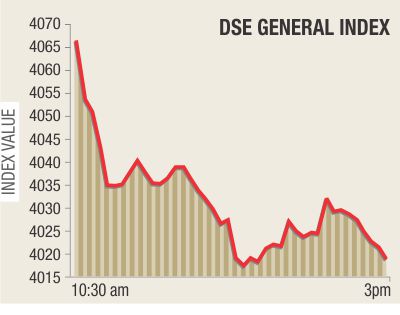

DGEN, key market tracking index of Dhaka Stock Exchange (DSE), finished the day at 4,018.06 points, after dropping 48.18 points or 1.18 percent.

Trading at the premier bourse started an hour late at 11:30 am due to technical fault.

“This problem will not re-occur again as we have already rectified it once and for all,” a DSE official said.

The bourse observed active sell pressure from the very beginning and to end the day in the red.

“The bourse got another blow by way of a countrywide eight-hour long road blockade. Most of the securities from every sector suffered from price corrections amid increased political violence during recent periods,” said IDLC Investments in its daily market commentary.

IPOs attracted investors' interests the most. For instance, Envoy Textile which debuted today obtained a 23.47 percent turnover, added the merchant bank.

“Market traded with bearish momentum all through the trading session. Although the current economic scenario is sluggish, forthcoming financing prospects and improving economic indicators suggest long-term prosperity” said LankaBangla Securities in its market commentary.

The stockbroker added: “Investors are discounting the fact that the financing prospects of Padma Bridge have become bleak again due to the World Bank and the government failing to reach an agreement.”

Turnover, however, remained almost flat compared to the previous session at Tk 213 crore, with 5.18 crore shares and mutual fund units changing hands on the premier bourse.

Losers beat gainers by a huge margin of 214 to 37, with 13 securities remaining unchanged on the DSE floor.

All the major sectors posted losses on the day: non-bank financial institutions dropped 1.89 percent, followed by power 1.65, banks 1.56 percent, telecommunications 0.72 percent and pharmaceuticals 0.46 percent.

Envoy Textile was the most traded stock of the day, thanks to its transaction of 80.21 lakh shares worth Tk 50.16 crore.

The company also was the biggest gainer of the day, posting a 106 percent gain.

The Jamuna Oil Company was the worst loser of the day, plunging by 27.64 percent.

News: The Daily Star/Bangladesh/10th-Dec-12

Stocks dip on inactive institutional investment

Stocks declined for the third week, as investors kept selling shares and mutual fund units ahead of the Eid festival and Durga Puja, while institutional investors preferred monitor the market.

DGEN, the benchmark general index of Dhaka Stock Exchange, finished the week at 4,458.57 points, after falling 23.69 points, or 0.53 percent.

Daily average turnover declined 13.07 percent to Tk 499 crore, compared to the previous week.

"The market closed marginally lower as investors went for withdrawing fund ahead of Eid festival," said Mohammad A Hafiz, president of Bangladesh Merchant Bankers' Association.

The market declined last week as investors sold shares ahead of Durga Puja and Eid-ul-Azha, market analysts said.

Institutional investors were waiting for the third quarterly earnings declaration of some listed companies before making any long-term investment decision, they said.

“The upcoming Eid festival and initial public offerings issues pulled out a portion of fund from the market, while the investors were waiting for earnings based market movement after disclosure of quarterly earnings of some listed companies," stated IDLC Investments in its weekly analysis.

The present market situation is normal and the investors are not 'panicked' rather they are 'indecisive' regarding future market movement, said the merchant bank.

The turnover fell sharply last week before the festivals for which the holidays will start from October 24, said BRAC EPL Stock Brokerage.

Among the five trading sessions of the week, two sessions lost 55.08 points while three sessions gained 31.39 points.

Out of the 281 issues that traded on the DSE floor, 127 advanced, 143 declined and 11 remained unchanged in the week.

All the major sectors closed in the red. Telecom lost 1.85 percent followed by non-bank financial institutions 1.16 percent, pharma 0.83 percent, power 0.11 percent and banks 0.71 percent.

The highest gainer of the week was mutual fund, which gained 4.01 percent, while cement rose 3.61 percent.

The mutual fund also dominated the top 10 gainers' list as six issues of the list came from the sector.

Over the last week, energy sector issues were the most traded, accounting for 17.70 percent of the total trade, as the dividend declaration of the major companies of the sector is forthcoming.

United Airways featured in the most traded stocks chart with 9.05 crore shares worth Tk 277 crore changing hands.

Bangas was the highest gainer of the week, posting a rise of 18.44 percent, while aamra technologies was the worst loser, plunging by 18.54 percent.

News: The Daily Star/Bangladesh/21th-Oct-12

Others beyond Sonali involved in scam

Finance Minister AMA Muhith yesterday said many from outside the Sonali Bank were involved in the much-talked-about Hall-Mark swindle.

Without mentioning any names, he said those linked to the scandal had been identified following much investigation. And cases would be filed in this regard “very soon”.

Muhith added it was a mistake on his part to say that crores of taka swindled out of a Sonali Bank branch was a petty sum.

“I have acknowledged my mistake, and those who don't admit mistakes lack moral strength”, he told reporters at his secretariat office hours before leaving for China last night on a 10-day tour to join the World Economic Forum meeting.

The minister replied to journalists' queries on a number of issues, including Padma bridge funding, Grameen Bank and Mashiur Rahman's and his resignation.

Recently, a Bangladesh Bank probe found serious anomalies in the lending of Tk 3,606 crore to the Hall-Mark Group and five other companies.

Half of the loans, granted by the Sonali Bank's Ruposhi Bangla Hotel branch, were based on forged documents.

Muhith yesterday said it was quite impossible that such a grave offence was being committed and yet nobody in Sonali Bank had noticed it.

Replying to a query about extending the tenure of the Sonali Bank chairman and directors for another two years, the finance minister said a three-member board led by the chairman would remain in office.

Muhith said a government official and a chartered accountant had been kept as board members and the tenure of no other director had been extended.

A board is necessary for taking decisions on a number of matters, including cases regarding the scam, he added.

The minister said the Sonali Bank board would be reconstituted and a decision in this regard taken on his return from China.

About the demand for his resignation, he said, “There are many demands like this …. But I have not taken any decision.”

The minister also spoke on the bridge project. “We have been in talks with the World Bank, Asian Development Bank and Japan International Cooperation Agency (Jica) in this regard. I will speak about this after the talks conclude.”

Muhith declined to comment on the WB condition relating to the removal of the Prime Minister's Economic Affairs Adviser Mashiur Rahman for the funding of the project.

“Talks are also going on with the World Bank about this matter. I cannot say anything about this at this point.”

GRAMEEN BANK

Also yesterday, Muhith defended a recent change in the Grameen Bank Ordinance, saying the government had brought in the amendment to appoint a full-time managing director.

The appointment “must be done”; it had long been pending owing to objections apparently from directors, he said.

The world-renowned microcredit organisation has been run by an acting chief executive since its founder, Nobel Laureate Prof Muhammad Yunus, stepped down in May last year.

Grameen Bank supporters both at home and abroad and also the nine elected women borrower-directors say the change has been introduced to curb the authority of the majority of the board in choosing the managing director and give more powers to the government-picked chairman.

The minister also said the law did not permit the powers exercised over the last 27 years in appointing the managing director.

"The government allowed this to let a good thing continue. But there are two sides of the coin -- one is flexibility and the other is unaccountability,” he added.

News: The Daily Star/Bangladesh/10-Sep-12

Stocks rally for second day

Stocks gained 2.78 percent yesterday, the highest this month, owing to institutional investors' increasing participation in the market.

Stocks gained 2.78 percent yesterday, the highest this month, owing to institutional investors' increasing participation in the market.

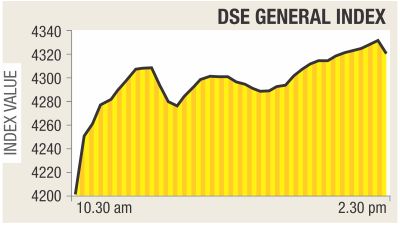

The rally continued for a second consecutive day as DGEN, the benchmark general index of the Dhaka Stock Exchange, gained 116.91 points to close the day at 4,318.79 points.

The opening 30 minutes of the day saw a rise of 110 points, and the momentum continued until the close of trade.

“Institutional investors, including banks, which publicised their intent to make fresh investments, followed up and bought shares, while some corporate dividend announcements, too, improved investor sentiment,” said Ahmed Rashid, senior vice president of the DSE.

Rashid added that the market is on its way to stability and is hopeful of a boost to small investors' confidence.

“New commitments from banking institutions reassured the investors that the liquidity would remain aplenty during the forthcoming period,” said LankaBangla Securities in its market analysis.

Latest policy decision by the government regarding the Padma bridge project also added to investors' positive outlook, it said.

“The rally went on for a second consecutive session, with improved turnover as well. Expectation of the rally persuaded investors to make fresh investments,” said IDLC Investments in its market commentary.

Turnover stood at Tk 289 crore, a 38.87 percent rise from the previous day.

A total of 0.89 lakh trades were executed on the premier bourse, with 6.58 crore shares and mutual fund units changing hands.

Among the major sectors, non-life insurance gained the most at 4.99 percent.

Non-bank financial institutions, power and textile were the other noteworthy movers, having risen by 3.97 percent, 2.66 percent and 2.37 percent respectively.

Of the 268 issues that traded on the DSE, 247 gained, 14 declined and seven remained unchanged.

Grameenphone was the top traded stock of the day, recording transactions of 6.85 lakh shares worth Tk 14.24 crore.

Beximco and Bangladesh Submarine Cable Company were the next popular stocks, registering figures of Tk 13.79 crore and Tk 12.64 crore respectively.

The biggest gainer of the day was Dhaka Insurance with its 9.98 percent rise, while Beximco lost the most, at 12.18 percent.

The Daily Star/Bangladesh/ 25th July 2012

Why is the response to economic crisis not more serious?

The state of the world economy these days reminds me of the famous telegram from an Austrian general, responding to his German counterpart toward the end of World War One. The German described the situation in his sector of the Eastern front as “serious but not catastrophic”. In the Austrian sector, the reply came, “the situation is catastrophic but not serious”. In much of the world today the economic situation is verging on catastrophic, but “not serious” seems a perfect description of the political response.

Four years after the Lehman crisis, economic activity and employment in the OECD has not yet returned to its pre-crisis level. Unemployment is at postwar highs in every major European country apart from Germany and, while the US jobless rate is now a little below its postwar record, it has been stuck above 8 percent for longer than at any time since the Great Depression. And in Britain, the long-term loss of output assumed by the government's latest budget forecasts implies, according to Goldman Sachs calculations, that the six months of the post-Lehman crisis did greater permanent damage to the country's productive capacity than the Great Depression or World War Two.

Now consider the response. In the US, the four years since Lehman have been dominated by economic debates among politicians, media commentators and business leaders on issues that are almost totally irrelevant to unemployment and the pace of economic recovery: how to reduce long-term budget deficits and whether to tweak the top rate of income tax from 36 percent to 39.6 percent. In Britain, the biggest economic controversy this year has been the extension of value added tax to hot pies. Europe's response to the deepest economic depression in living memory -- and an even more alarming xenophobic nationalism that threatens the literal disintegration of the euro and the European Union --has been to debate the bureaucratic “modalities” of bank regulations, fiscal treaties and pension reforms in the next decade.

How to explain this insouciance in the face of the gravest threat to the Western world since the height of the Cold War? In the US and Britain the answer is straightforward, if unappealing: party politics. In Britain, the Conservative-Liberal coalition has managed to lay all the blame for the country's economic troubles on Labour's Gordon Brown, so far at least. Thus there has been very little public pressure on the Cameron government to change its economic policies, and no political advantage in doing so.

In the US, the Obama administration's efforts to revive the economy with public spending have been stifled by congressional Republicans, while Democrats have thwarted conservative ideas about using tax cuts to stimulate enterprise, investment and consumption. Business leaders and media opinion-formers have aggravated this political impasse by whipping up fears about budget deficits, despite the record-low yields set by the markets on US Treasury bonds.

The good news is that US politics created a self-stabilising feedback of sorts. If the US economy continues to deteriorate, the Republicans will probably win both the presidential and congressional elections and would then be free to pursue an aggressive tax-cutting policy modelled on Reaganomics. Big tax cuts would doubtless increase budget deficits, but they might well pull the US out of recession as they did in 1983. If, on the other hand, the US resumes tolerable levels of economic growth and employment creation, then a re-elected Obama administration would have a strong mandate to overcome or co-opt what would then be a chastened Republican opposition.

Now for the bad news, which comes, of course, from Europe. The euro zone, in contrast to the US and Britain, is paralysed not by cynical political calculations but by profound misunderstandings of economics and finance. European leaders do not seem to understand that the fiscal and banking unions they are relying on to save the euro can only work under a very specific political condition: Restrictions on national sovereignty over budgets and bank regulation (as demanded by Germany and resisted by France, Italy and Spain) have to be agreed on at the same time as mutual support for debts (as demanded by France, Italy and Spain, and resisted by Germany). Moreover, the banking and fiscal unions can only work if they are backed by a central bank commitment to buy government bonds and thereby maintain near-zero interest rates for a long period, as in the US and Britain.

Anatole Kaletsky is an award-winning journalist and financial economist who has written since 1976 for The Economist, the Financial Times and The Times of London before joining Reuters.

The Daily Star/Bangladesh/ 15th July 2012