Agrani gives lifeline to troubled Beximco

Fourth state bank decides to reschedule Tk 775cr loans for Salman's company

Fourth state bank decides to reschedule Tk 775cr loans for Salman's company

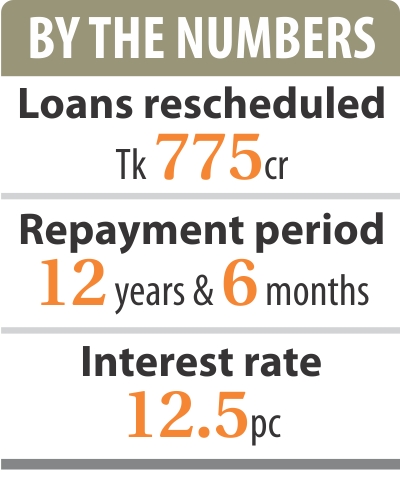

Taking cues from Sonali, Janata and Rupali, Agrani Bank has now decided to reschedule Beximco Group's loans of Tk 775 crore.

The loans must be repaid in 12 years and six months, which is longer than what the other banks have offered. But it has made the conditions harder.

The grace period for repayment will be only three months from the date of activation of the rescheduled package.

Agrani has opted for a 'ballooning' payment schedule, meaning the repayment amount will be small at the beginning and increase progressively, a high official of the bank said.

In contrast, the other three banks gave grace periods of two years, with the repayment in equal instalments.

The interest rate offered by Agrani is 12.5 percent against 11 percent by Rupali and Janata and 10 percent by Sonali. The original interest rate on the loans is 13-14 percent.

Beximco will also have to make a token down-payment to Agrani, which would be 25 percent of the required down-payment for the loans. It will also have to deposit Tk 1,000 crore as additional collateral for rescheduling the loans.

The Agrani board agreed to reschedule the loans seeing Beximco's tight cash flow situation, according to the bank's Chairman Zaid Bakht.

The company last year repaid Tk 700-800 crore to different banks but it is going through a cash crunch now, he said. “Considering their contributions to the economy, we have decided to give them more time to repay the loans.”

Subsequently, the board last week approved the restructuring proposal from Beximco and forwarded it to Bangladesh Bank for its go-ahead.

The move to reschedule Beximco's loans comes after its Vice-chairman Salman F Rahman approached the central bank in August last year with a debt rescheduling plan of Tk 5,269 crore.

Rahman appealed to the BB to bail Beximco out of an acute liquidity crisis. This prompted the regulator to forward the proposals to all seven banks that gave loans to the group.

Consequently, in November last year, Sonali Bank agreed to reschedule Tk 982.44 crore of Beximco's loans, Janata Tk 1,849 crore and Rupali Tk 604 crore.

Sonali and Janata approved the conglomerate's loan rescheduling proposals without taking any down-payment, but Rupali took Tk 11 crore.

Other private banks have already submitted their proposals for rescheduling Beximco loans to the central bank in line with the state banks.

However, no rescheduled packages have taken effect yet: they are all awaiting the green light from the central bank.

A BB high official said a restructuring policy on large loans will be prepared first and then the proposals for Beximco will be reviewed.

The draft restructuring policy may be placed at the BB board meeting at the end of the month.

The disclosure comes as the central bank board last month agreed not to reschedule or restructure large loans on an ad-hoc basis.

Loans amounting to more than Tk 500 crore may come under the restructuring policy. A loan rescheduled under this policy will not be considered for rescheduling again.

Besides Beximco, a number of other business groups have applied to the central bank for restructuring their loans.

News:The Daily Star/21-Jan-2015

Comments