Bangladesh slips two spots in WB's doing business rankings

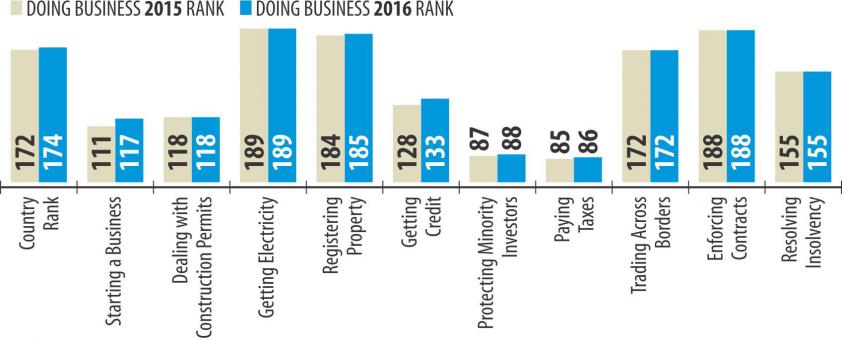

Bangladesh dropped two positions to 174 in the World Bank's ranking of the ease of doing business due to stalled regulatory reforms.

Only Afghanistan (177) among the eight South Asian countries came in lower than Bangladesh in the report, “Doing Business 2016: Measuring Regulatory Quality and Efficiency”, which was released yesterday.

Bhutan topped the ranking (71) in South Asia, followed by Nepal (99), Sri Lanka (107), Maldives (128), India (130) and Pakistan (138).

Not only that, Bangladesh's competitors, such as India, Sri Lanka, Vietnam, Indonesia and Cambodia, have all improved in their rankings in the new report.

Even Myanmar and Mauritania, which were below Bangladesh in the index last year, have moved ahead of Bangladesh now. War-torn Iraq (161) and Yemen (170) ranked above Bangladesh.

“This is a wake-up call for us to inject a new lease of life in regulatory reforms in order to increase the attractiveness of Bangladesh as a prolific investment destination vis-à-vis our international competitors,” said Zahid Hussain, lead economist of the WB's Dhaka office.

The movement in a country's ranking depends on the number of reforms it had implemented on various sub-indicators such as paying taxes, getting electricity and registering property, compared to the other 188 countries. Singapore topped the list, while Eritrea came in last.

This year, Bangladesh slipped because of lack of progress in implementing regulatory reforms while others moved fast forward, Hussain said.

Bangladesh's distance to frontier (DTF) score, which used to compile the rankings in the Doing Business report, improved on paying taxes because of reduction in the corporate tax rate. Bangladesh's DTF stood at 43.1 percent in the 2016 report, up from 42.71 percent a year ago.

“But our overall ranking still slipped because others did much better on this count,” said the WB economist.

Although the government has been trying to do a lot of positive things in recent years, they are slow in execution, said Shafiul Islam Mohiuddin, vice-president of the Federation of Bangladesh Chambers of Commerce and Industry.

Every year the WB's Doing Business report sheds light on how easy or difficult it is for a local entrepreneur to open and run a small to medium-size business when complying with relevant regulations.

The report tracks changes in regulations affecting ten areas in the life cycle of a business: starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency.

Bangladesh lost grades on five indicators and remained unchanged on the other five.

The country dropped the most in the index for starting a business, slipping six spots to 117.

It dropped five positions in the getting credit index and one spot each in registering property, protecting minority investors and paying taxes rankings.

Its ranking remained unchanged in: dealing with construction permits (118), getting electricity (189), trading across borders (172), enforcing contracts (188) and resolving insolvency (155).

Starting a business in Bangladesh requires nine procedures, takes up 19.5 days and costs 13.9 percent of income per capita, according to the report. South Asia on average needs 7.9 procedures, 15.7 days and 14 percent of income per capita for starting a business.

Although the government has been saying for long that it would simplify the business process, the fact of the matter is that the procedures have become more complex over the years, said Hossain Khaled, president of the Dhaka Chamber of Commerce and Industry.

“We still have to run from one office to another for days to get trade licences. These harassments are unbearable for business people.”

Globally, Bangladesh stands at 189 in the ranking of 189 economies on the ease of getting electricity. India ranked 70th in the getting electricity indicator, Sri Lanka 81st and Pakistan 157th.

It takes at least 429 days to get electricity in Bangladesh, compared to the South Asian average of 141.7 days, according to the WB study.

“We are facing serious problems in getting gas and electricity supplies. We are very concerned,” Khaled said.

And if the factories do manage to get the connection, the quality of supply of electricity and gas tends to be poor, he said. “The supply of electricity would be irregular and the pressure of gas low.”

In such a situation, the government went ahead and raised the prices of gas and power, Khaled said.

Currently, the amount of idle money in the banking system is huge, as the investors have limited scope for either expansion or fresh investment due to the higher cost of doing business, Khaled added.

Bangladesh ranks one of the lowest (185) in registering property. It requires eight procedures, 244 days and costs 7 percent of the property value for registration.

On the South Asia level, the study found that six of the eight economies have implemented nine reforms in the past year, compared with six reforms in four economies the previous year.

India, the region's largest economy, which has a global ranking of 130, implemented two reforms last year.

For example, India eliminated the requirements for a minimum paid-in capital and a certificate to commence business operations, and in so doing, it significantly streamlined the process of starting a business.

With the exception of Maldives, all economies in the South Asia region have now eliminated the minimum capital requirement, significantly reducing the costs of setting up businesses, the report said.

Bhutan and Sri Lanka also implemented two reforms each in the past year, while Afghanistan, Bangladesh and Maldives undertook one reform each.

The highest number of reforms came for starting business, paying taxes and getting electricity.

The report found that no reforms were recorded in areas of trading across borders, protecting minority investors, enforcing contracts and resolving insolvency.

News:The Daily Star/29-Oct-2015

Comments