Banks' surplus capital at adequate levels

The surplus capital in banks stands at Tk 4,218 crore, setting them at good stead for the Basel III preparations starting next year.

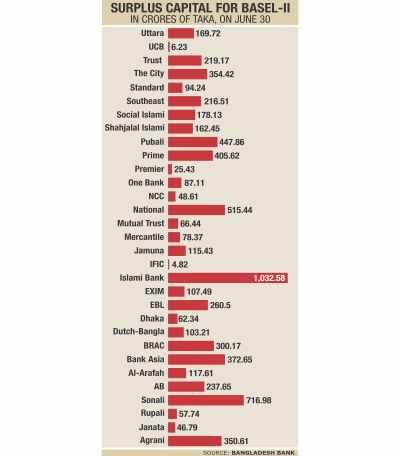

Of the country's 47 banks, all except five have surplus capital as per the international Basel II standards, which stipulate, as a rule of thumb, a capital base of 10 percent of the bank's liabilities.

As of June 30, the banks had a total capital of Tk 56,201 crore, whereas the capital requirement was Tk 51,983 crore, according to central bank statistics.

Of the 30 private commercial banks, three have a capital deficit: Bangladesh Commerce Bank of Tk 177 crore, First Security Islami of Tk 136 crore and ICB Islami Bank of Tk 1,192 crore.

Of the specialised banks, Krishi Bank and Rajshahi Krishi Unnayan had capital deficits -- of Tk 4,100 crore and Tk 359 crore respectively.

“Most of the commercial banks do not have capital deficits,” said a central bank official, asking not to be named.

“The few who do are problematic banks to begin with. Various measures are being taken to improve their capital adequacy.”

From 2015, the banks will have to maintain capital as per Basel III requirements, preparation of which will start next year, the official added.

The Basel Committee, named after the city of Basel in Switzerland, consists of central banks of 27 countries, including India, and sets the international standard for capital requirement.

“Globally the preparation for capital requirement as per Basel III has already started, but in Bangladesh it will start in the beginning of next year,” said Helal Ahmed Chowdhury, vice chairman of the Association of Bankers Bangladesh.

“The global financial of 2007-08 has compelled the Basel III to incorporate many risk factors in setting the capital requirements,” said Chowdhury, also the managing director of Pubali Bank.

Given the rise in loan defaults in Bangladesh, Bangladeshi banks would face many challenges to meet the Basel III requirements, he thinks.

“However, as per the Bangladesh Bank guidance most of the banks do not have any capital deficit. As a result, most of the banks will be able to maintain their capital to Basel III standards,” said a hopeful Chowdhury.

News: The Daily Star/Bangladesh/09-Sep-12

Comments