Buyback policy for govt securities on the cards

It may help cut govt's interest expenses

The government has planned to introduce a buyback arrangement for its securities to bring dynamism in the secondary market, officials said.

The government has planned to introduce a buyback arrangement for its securities to bring dynamism in the secondary market, officials said.

They said the Ministry of Finance, Bangladesh Bank (BB) and Primary Dealer (PD) banks will work jointly to formulate a policy and implement the plan.

At present, the government buys back its securities from the market as and when it thinks necessary due to absence of any policy. If implemented, the buyback would take place under the policy.

The decision emerged at a meeting of senior officials of the ministry, the BB and treasury heads of all the PD banks at the central bank headquarters in the capital Sunday, with BB executive director Dr. Abul Kalam Azad in the chair

"We're now working to boost the secondary securities market through buyback and other initiatives," a senior BB official told the FE.

He said the yields on the buyback securities would be fixed in line with the market rates.

Earlier, the government bought back its securities worth Tk 11.16 billion in the fiscal year (FY) 2007-08 and FY 2009-10, according to the BB officials.

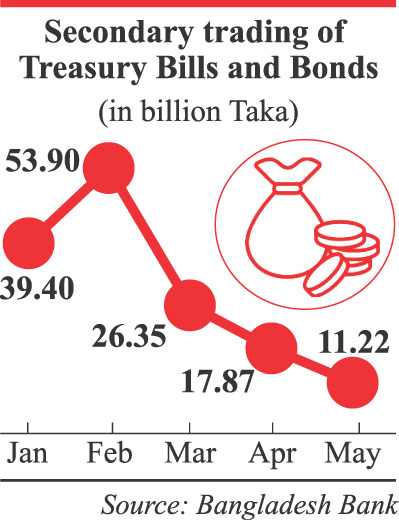

The latest move came against the backdrop of falling trend in trading at the secondary market mainly due to the lack of adequate securities.

Trading of both the Bangladesh Government Treasury Bonds (BGTB) and treasury bills (T-bills) dropped by more than 37 per cent in May than that of the previous month.

Total turnover that included both buy and sale came down to Tk 11.22 billion in May from Tk 17.87 billion a month ago, according to the central bank's latest statistics.

At the meeting, the PD banks proposed the government to formulate a buyback policy that will allow holding reverse auction of its securities as and when necessary.

"We also want the government to come forward with 'unconditional attitude' for encouraging the stockholders to participate the proposed reverse auction," a treasury head of a PD bank said, following the meeting.

He said the move would help cut the government's interest expenses against such securities while contributing to boost the secondary market.

The ministry officials informed the meeting that the government wanted to issue new securities and buy those back simultaneously in bringing dynamism in the market.

Currently, three T-bills (91-day, 182-day and 364-day) are being transacted through auctions to adjust the government borrowings with the banking system. Besides, five government bonds with tenures of 02, 05, 10, 15 and 20 years respectively are being traded on the money market.

The BB had earlier selected 20 PD banks to deal with the government securities on the secondary market.

Other Posts

- Monzur Hossain, Chairman, Board of Directors of Rupali Bank Limited, presiding over the 31st AGM at the bank head office in the city on Sunday. Ataur Rahman Prodhan, Managing Director, Professor Dr. Md Hasibur Rashid, Dina Ahsan and Professor Dr. Mohammad

- Excise duty on bank accounts not new

- Islami Bank, Transfast inaugurates special promotional program

- Alhej Engineer Md. Towhidur Rahman, Chairman of Shahjalal Islami Bank Limited, presiding over a discussion on the significance of 'Mahe Ramzan and Iftar Mahfil at a hotel in Khulna city on 8th June. Farman R Chowdhury, Managing Director of the bank, Fazlu

- Dollar shortages hit Qatar exchange houses as foreign banks scale back ties

- AB Bank hosts Iftar party

- Note ban has and may continue to result in a slowdown: SBI

- US Fed to raise rates despite sluggish economic data

- Khalilur Rahman, Chairman, Al-Arafah Capital Market Services Ltd. inaugurating the 144th Branch as chief guest at Bhatiari, Sitakunda in Chittagong on Sunday. Abdus Samad Labu, Chairman, Md. Habibur Rahman, Managing Director, Abus Salam, Vice-Chairman, Ah

- China unlikely to see liquidity crunch

Comments