Remittance slid 16 percent year-on-year in the first ten months of the fiscal year in continuation of the sluggish trend that is threatening the country's foreign currency reserves, growth and poverty reduction efforts.

Between the months of July last year and April this year, Bangladesh received $10.28 billion in remittance, according to data from the Bangladesh Bank.

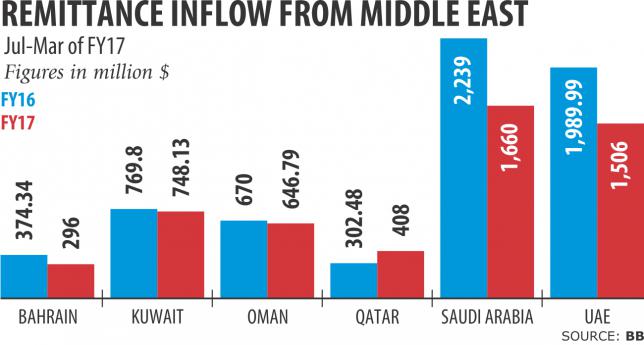

The decline in remittance flow from the six Gulf Cooperation countries, the largest labour market for Bangladesh, mainly accounts for the slump.

Remittance inflow from Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates shrunk 17 percent to $5.26 billion in the July-March period of the fiscal year.

This stands in stark contrast to the huge numbers of Bangladeshi nationals taking up jobs in the six GCC countries in recent years.

If the slow remittance growth trend continues into the new fiscal year, the local currency will devalue, said AB Mirza Azizul Islam, a former adviser to the caretaker government, adding that the current account deficit will also increase.

The exchange rate of the dollar crossed Tk 80.5 in May, up from the average of Tk 78 in the last several years.

The current account balance was $1.38 billion in the deficit in the first nine months of the fiscal year in contrast to being $3.35 billion in the surplus a year earlier. “Though it is said that remittance inflow has declined, it is not true,” said Abul Barkat, former president of the Bangladesh Economic Association.

The figure shown by the BB is only the amount that came through the banking channel, he said, while urging the government to find out the actual remittance figure by tallying the amounts coming through both the formal and informal channels.

Islam, however, disagrees with Barkat. “Though it is often claimed that the unofficial remittance figures are way higher, I believe that remittance growth has really dropped.”

The Middle Eastern countries are going through an economic downturn due to a fall in oil price. Even Saudi Arabia, a large labour market for Bangladesh, is facing budget deficit. As a result, migrant workers are losing jobs or seeing wage cuts, both of which account for the slump in remittance inflow.

The World Bank recently said the low oil prices, weak economic growth and fiscal tightening in GCC countries and the Russian Federation were taking a toll on remittance flows to South Asia and Central Asia. “If the current trend continues, consumption of those who are remittance recipients will shrink,” Islam added.

The slower remittance growth will put pressure on the exchange rate by depreciating the local currency, said Biru Paksha Paul, former chief economist of the central bank.

But the depreciation will not have a negative impact on the economy immediately as the devaluation of the local currency will encourage remitters to send money through the proper banking channel.

He also suggested the BB take measures to spread remittance services in remote areas to encourage expatriates to send money home through the formal channel. Remittance is the largest source of foreign exchange in Bangladesh after exports.

Money sent by Bangladeshi workers, which accounted for about 6 percent of the gross domestic product in fiscal 2015-16, supports growth through their impact on household income and consumption.

Remittances accounted for about 30 percent of the current account receipts in 2014-15, more than offsetting the trade deficit.

news:daily star/31-may-2017

Comments