Economics

Foreign exchange reserves mark rise, remittances inflow registers decline

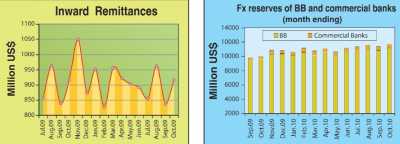

The country’s foreign exchange reserves stood at US$ 10.949 billion on December 22 this year compared with $10.32 billion a year ago, showing a 6.09 percent rise.

The country’s foreign exchange reserves stood at US$ 10.949 billion on December 22 this year compared with $10.32 billion a year ago, showing a 6.09 percent rise.

But the reserves were lower by $211 million or 1.89 percent compared with $11.16 billion recorded in October, 2010.

The gross foreign exchange reserves in October this year, without ACU (Asian Clearing Union) liability is equivalent to import payments of 5.22 months. The imports were worth $ 2.14 billion per month based on the previous 12 months average.

The gross foreign exchange balances held abroad by commercial banks stood at $ 583.21 million by end October, 2010 against $ 508.90 million in September, 2010. The figure was $460.06 million in October, 2009.

Meanwhile, the remittances receipts during July-November of fiscal 2010-11 totaled $4.529 billion, lower from $ 4.659 billion during the same period of last fiscal, showing a decline by $130 million or 2.79 percent.

The inflow of remittances during July-October, 2010 fell by $32.63 million or 0.90 percent to $3.576 billion against $3.609 billion during July-October, 2009.

The remittances sent by the non-resident Bangladeshis during November this year was $ 945.99 million against $1.051 billion in the same month last year.

The remittances during fiscal 2009-10) was recorded at $10.973 billion, the central bank’s statistics showed.

The exports receipts of the country during July-October, 2010 increased by $1.828 billion or 37.35 percent to $ 6.721 billion compared with $ 4.894 billion during July-October, last fiscal.

The import payments of the country during July-October period of fiscal 2010-11 amounted to $9.547 billion against $7.159 billion during the same period of last fiscal year, indicating a rise by $ 2.388 billion or 33.36 percent.

In October this year, the country had to make import payments worth $ 2.526 billion against $2.032 billion in the same month of last fiscal, up by $494 million or 24.31 percent.

During July-September, 2010, the import payments of the country increased by US$1.897 billion or 37.02 percent to $7.022 billion compared with $ 5.125 billion during the corresponding period of last fiscal.

Meanwhile, the settlement of import LCs (Letter of Credits) during July-September, 2010 increased by $2.068 billion or 42.66 percent to $6.915 billion against $4.847 billion during the same period of last fiscal year.

Fresh opening of import LCs during July-September, 2010 increased by $ 2.527 billion or 39.25 percent to $ 8.965 billion against $6.438 billion during July - September, 2009.

Source: Daily Sun

ICBA National Award to 22 Organizations

Twenty Two (22) organizations of Bangladesh won the tenth Institute of Chartered Accounts of Bangladesh (ICAB) award this year. Based on the accounts and reports of several organizations, published in 2009, ICAB has awarded this award to Bank, non-bank, production, IT and non-governmental organizations. This ceremony took place yesterday evening in the Sheraton Hotel of the capital.

Mr. Abul Mal Abdul Muhit was present in the ceremony as a chief guest. ICAB chair Mr. Jamaluddin Ahmed, assistant chair Mr. Shahjahan Majumder and the chair of evaluation committee Mr. Abu Sayeed delivered their speech to the audience. Finance minister Mr. Abul Mal Abdul Muhit said that several organizations are doing well in making accounts report. He also said that such transparency is needed where money is related. Jamal Uddin Ahmed informed that since 2001 ICBA is presenting this award. As a result organizations put emphasizes on improving economic review of their organizations. This helps to attract foreign investors and make them interested to invest in our country.

Finance Minister distributed crest and certificates to the Chief Executives and senior officers of the organizations, present in the program.

Awarded Organizations in Bank Category: Prime Bank (1st), Eastern Bank (2nd) and Dutch-Bangla Bank (3rd). Premier Bank, BRAC Bank and National Bank also won the honorary award in the same category. In the non-Banking category Green Delta and Reliance Insurance won the award. Prime Finance and Investment Limited, IDLC and Lanka Bangla also got the award in the same category. In the production sector Glaxo Smith Cline Bangladesh Limited became first. Singer and ACI won the second and third prize.

GrameenPhone was awarded in the communication and IT sector and BRAC became first in the NGO category where Sajeda Foundation and Bureau Bangladesh and Uddipon became second and third. Agrani Bank got this award from Governmental organization. Agrani Bank and Prime Bank also won prizes for corporate discipline and good administration.

News Source: Prothom Alo/20 Dec 2010

Allahabad Bank of India will open Branch in Bangladesh

Allahabad Bank, a Calcutta based local bank of India, is planning to open a branch in Bangladesh, news of Economic Times. This bank took initiative to open separate branches in China, Singapore and Hong Kong. J. P. Dua, Chairman and Managing Director of Allahabad Bank, informed that they have already asked for permission to the central bank of India, Reserve Bank of India (RBI) for opening these branches.

Currently Allahabad Bank has only one foreign branch in Hong Kong. In the past two years this branch was successful in making profit to run it. Apart from this there is a representative office of Allahabad Bank in Shen Ben of China. Bank authority wishes to convert this branch in a fully fledged branch. This bank has managed to deal a foreign business of One thousand and two hundred Rupees with only a branch and a representative office. The Bank authority is hopeful to make this business thrice in the next two years.

Mr. Dua also informed that they have plan to open forty more branches in India in the next three years.

News Source: Prothom Alo/20 Dec 2010

WB fund Tk 1,027.50cr financing to create jobs for the poor

Dhaka, Dec 18: The World Bank (WB) will provide Tk 1027.50 crore, (equivalent to $ 150 million) to Bangladesh, aimed at creating jobs for 100 days in the rural areas for the extreme poor during two lean seasons a year. The programme covers one lean season from October to December and another from March to May when rural day labourers are often out of work.

The households, where the head is a manual labourer and which have less than half an acre of land will be eligible for the programme. It is estimated that over 600,000 men and women will benefit from the programme during each lean season.

The disaster management and relief division of food and disaster management ministry will implement the programme from January 2011 to December 2013.

A credit agreement between the government and WB was signed for the “Employment Generation Programme for the Poorest” at the economic relations divisions (ERD) at Sher-e-Banglanagar in the city yesterday, ERD secretary, M. Musharraf Hossain Bhuiyan and WB country director Ellen Goldstein signed on behalf of their respective sides at a ceremony held at the ERD. It was attended by senior officials of the ERD and WB.

After the signing ceremony M. Musharraf Hossain Bhuiyan told reporters the programme would create two crore person-days of employment over a three year period. “The Government is committed to extend the safety net to protect the poorest and the vulnerable population, while ensuring a more efficient, accountable and transparent system” Bhuiyan said.

Wages to the day labourers will be paid through formal financial channels to ensure the efficiency and transparency of the system, the ERD secretary observed.

The programme will generate employments for the day labourers, particularly for the vulnerable women, who are often out of work during the lean season, he added.

Despite considerable progress in poverty reduction during the past 20 years, many of the poorest women are still without employment, Bhuiyan said, adding that the programme would ensure that the poorest women make up at least one-third of those employed.

“Our mandate is to reduce poverty, which requires shared growth, in which the poorest are not left behind” said Ellen Goldstein after signing the agreement and added “The WB will provide funds for the wage-earners, but will also help ensure that funds are well-targeted to those who are most in need,” she noted.

“Building upon the government's earlier employment generation interventions, the programme will target both the poorest upazilas and the poorest households,” she noted adding that “it will address seasonal poverty by allowing the poorest to have an income, which can be scaled up if the situation demands.”

The credit from the International Development Association (IDA) has 40 years to maturity, including a 10-year grace period, and carries a service charge of 0.75 per cent.

Source: The Independent, Bangladesh/19th Dec 2010

Govt to offload 3m Rupali Bank shares

Dhaka, Dec 15 (bdnews24.com) — The government has decided to offload more than three million shares of the state-run Rupali Bank Limited in the secondary market.

A news posting on the Dhaka Stock Exchange website noted that 30,68,750 shares of the bank would be brought to the secondary market for trading.

Earlier on November 24, the government declared to float in the market 24.55 percent or 28,57,380 shares of the bank.

In November the government decided to offload more shares of state-run companies already listed with bourses in the wake of overheating of the capital market.

Investment Corporation of Bangladesh (ICB) would work as the issue manager for Rupali.

Currently, only a limited number of shares of 12 SOEs are traded on the stock market, while the government maintains a strict policy of holding over 51 percent of the shares to continue its 'management authority' on the entities.

But the recent hype in the capital market forced the government to change its position while the parliamentary watchdog on finance ministry recommended for offloading more shares of the SOEs to increase share supply in the capital market.

Source: bdnews24.com/15th Dec 2010