When will regulators act like regulators?

The headline of a front-page story in the October 02, 2012 issue of the Financial Express was, "Banks' stock market exposure set at 40pc, BB denied control over SCBs." The news basically says that in the proposed amendments of Bank Company Act (BCA), 1991, the maximum limit of a bank's exposure to the capital market has been set to 40 per cent of the total paid-up capital of a bank. The existing exposure limit of a bank is 10 per cent of its total liabilities as stipulated in the existing BCA (amended), 2003. On October 03, 2012, other leading newspapers also carried news on this subject and said that this decision would benefit the stock market in Bangladesh as banks will be able to invest more once the amendment comes into effect. All those news and the aftermath pointed out two facts: one, market is smart and the other, there is severe regulatory failure.

The headline of a front-page story in the October 02, 2012 issue of the Financial Express was, "Banks' stock market exposure set at 40pc, BB denied control over SCBs." The news basically says that in the proposed amendments of Bank Company Act (BCA), 1991, the maximum limit of a bank's exposure to the capital market has been set to 40 per cent of the total paid-up capital of a bank. The existing exposure limit of a bank is 10 per cent of its total liabilities as stipulated in the existing BCA (amended), 2003. On October 03, 2012, other leading newspapers also carried news on this subject and said that this decision would benefit the stock market in Bangladesh as banks will be able to invest more once the amendment comes into effect. All those news and the aftermath pointed out two facts: one, market is smart and the other, there is severe regulatory failure.

The proposed amendment, available on the Bangladesh Bank's website, says that banks will be able to invest in the stock market 40 per cent sum of their total paid-up capital, share premium and statutory reserve - not only paid-up capital. All these three components, total paid-up capital, share premium and statutory reserve, are subset of total equity on the balance sheet. Total equity component of a bank can include many other items beyond those three elements. Many times, banks' statutory reserve could be higher than paid-up capital. Share premium could be zero to any amount.

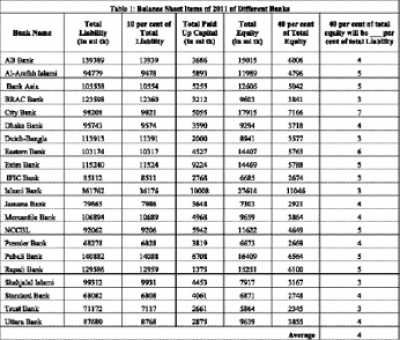

It is not correct to say that setting banks' stock market exposure at 40 per cent in the proposed amendment will increase banks' investment in the stock market. And of course, data doesn't support that kind of conclusion. Because of the nature of its business, bank's total liability is much higher than its paid-up capital or even total equity. To make our analysis easier and consistent across the board, let's make an assumption that in the amendments of Bank Company Act, banks are allowed to invest 40 per cent of their "total equity" instead of only paid-up capital, share premium and statutory reserve. Generally speaking, sum of paid-up capital, share premium and statutory reserve is lower than total equity of a listed Bank. As already has been mentioned, the paid-up capital, share premium and statutory reserve are elements of total equity component on the balance sheet.

This article is based on my study of balance sheets of 21 listed Bangladeshi banks in 2011. (See the Table). For nine out of 21 banks, 21, 10 per cent of the total liability is even greater than total equity. For all the sample banks, 10 per cent of total liability is more than double when compared with 40 per cent of the total equity. On Average, 40 per cent of total equity looks like 4 per cent of total liability. Thus, in the proposed amendment, the ability of banks to invest in the stock market is actually reduced, on average, by more than 60 per cent when compared with existing exposure limit, i.e., 10 per cent of the total liabilities. So, if proposed amendment comes into effect, it will actually demand banks to reduce their investment in the stock market substantially.

Market also responded immediately to the newspaper reports on the proposed amendment of the Bank Company Act. On October 02, DSE (Dhaka Stock Exchange) General Index (DGEN) increased 2.55 per cent or 117 points. Out of 2.55 per cent increase in DGEN Index, banking sector alone represented 1.31 per cent or 60 points. However, the market is smart. The market found the loopholes in the newspaper reports and quickly adjusted as necessary which was reflected in the subsequent market returns. After the October 02 market rise, stock market declined for the next four consecutive business days.

Unfortunately, the whole situation is also an example of regulatory failure. None of the regulatory organisations, such as, the Bangladesh Bank, Securities and Exchange Commission (SEC) and the Dhaka Stock Exchange (DSE), came up with proper explanation of the proposed amendments in the Bank Company Act (BCA), and ultimately general investors had to pay the price. It takes years to instill confidence among investors but needs just a second to destroy it. The incident actually raised serious doubt on SEC's effort to control rumour and manipulation in the stock market. When will the regulators actually act like regulator?

The writer is a Faculty, School of Business, Independent University, Bangladesh (IUB).

mainul188@gmail.com

News: The Daily Financial Express/Bangladesh/21th-Oct-12

Other Posts

- Malaysia works on free trade deal with Bangladesh

- EU leaders seal bank watchdog deal

- Banks continue to defy BB directive on spread

- Stocks dip on inactive institutional investment

- Bangladesh Bank Governor Dr Atiur Rahman receives donation from Association of Bankers Bangladesh.

- Rupee plunges to 1-mth low on heavy dollar demand

- City Bank, Siemens sign agreement

- Southeast Bank's new AMD

Comments