Bank deposit rates fall sharply

Clients having good records offered loans at single digit interest rate

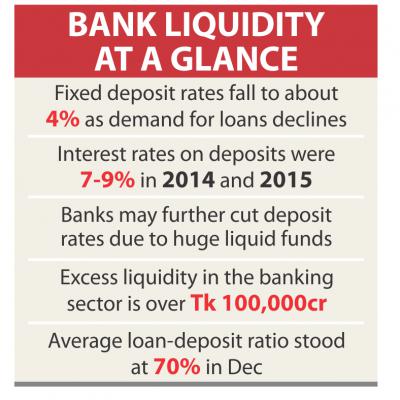

Fixed deposit rates have come down to as low as 4 percent on the back of low demand for loans, bankers said.

The country's inflation is at 6.2 percent but banks offer 4-4.5 percent for deposits of 3-12 months, meaning a depositor's earning will become negative.

In addition, interest rate earned on bank deposits is subject to tax of 10-15 percent. After paying the tax, a depositor's net earnings will be negative by around 2 percentage points.

Industry analysts found that interest rates on deposits were 7 percent to 9 percent for most of the time in 2014 and 2015, down from 11-12 percent in 2013.

“We will further cut our deposit rates as we have huge liquid funds,” said Anis A Khan, managing director of Mutual Trust Bank and chairman of Association of Bankers Bangladesh.

Presently, MTB offers 4 percent interest rate for fixed deposit of 2 months' tenure and highest 7 percent for 3-year deposits.

Khan said lower demand for overall credit, less government borrowing, declining inflation and inflow of remittances are contributing to the declining deposit rates.

The banks appear to be in a race to reduce deposit rates in the wake of piling funds.

As of December last year, the banking sector had excess liquidity of more than Tk 100,000 crore.

The average loan-deposit ratio of banks stood at 70 percent at the end of December, although they could have lent at least Tk 80 against every Tk 100 deposit, according to Bangladesh Bank data. Treasury officials at different banks are in a fix on how to handle their money as the demand for credit has been waning since 2013.

Private sector credit growth came down to less than 13 percent in December 2015 from over 25 percent in 2011.

The situation has forced banks to abandon high-cost deposits and concentrate on low-cost current and savings accounts.

“We have released high-cost deposits last year to reduce pressure on fund management and profitability,” said Ahmed Kamal Khan Chowdhury, managing director of Prime Bank.

Prime Bank offers a maximum of 5.5 percent for fixed deposits regardless of the tenure. It gives the highest 4.5 percent for short-term fixed deposits. “When I have excess funds, I don't need deposits,” Chowdhury said, hinting at further cuts in his bank's deposit rates in the coming days.

In addition to lower demand for loans from businesses, he said no borrowing by Bangladesh Petroleum Corporation for oil imports and declining commodity prices across the world have affected the banks' business.

Pubali Bank, which is the largest private bank in terms of branch network, offers 6 percent interest for fixed deposit.

“I am under pressure to slash the rate further,” said Abdul Halim Chowdhury, managing director of Pubali Bank.

Muklesur Rahman, managing director of NRB Bank, one of the nine new banks, said they offer 6 to 8 percent rates for fixed deposits depending on the tenure and amount, down from 10 plus percent interest a year ago.

Rahman said he wants to slash the rates further, but as a new bank he cannot do it unless interest rates in savings certificates come down from 11 percent.

Most of the foreign banks operating here are discouraging deposit collection in response to the lower demand for loans.

As of December 10, 2015, Citi's deposit growth went nearly 8 percent in the negative year-on-year, while HSBC's deposit growth was minus 0.58 percent.

When the depositors' earning is declining, borrowers are cheering up as they are getting loans at single digit, which never happened in Bangladesh except in some extraordinary cases.

News:The Daily Star/29-Jan-2016

Comments