BASIC managers take pay cuts

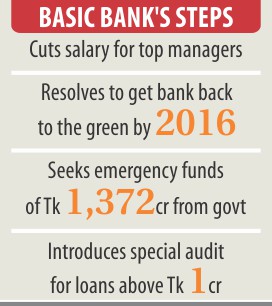

In an extraordinary move, BASIC Bank's top managers have forfeited a certain portion of their monthly gross salaries in a bid to minimise the operating costs in the face of financial tribulations.

The bank's six deputy managing directors have given up Tk 30,000 each from their gross monthly salaries and the 12 general managers Tk 20,000 each -- a first in the country.

“The management voluntarily took the initiative. There was no pressure from the board, but they appreciated the decision,” Mojib Uddin Ahmed, a director of the bank, told The Daily Star yesterday.

The move is part of the action plan that BASIC sent last week to the finance ministry to rescue the ailing bank by 2016.

Presently, the state-run bank's DMDs draw Tk 4 lakh as monthly gross salary and the GMs Tk 2 lakh. The forfeited amount will be kept in one of the deposit pension schemes of the bank and if BASIC sees net profits by 2016, the sum would be paid back to the 18 officials.

A high official of BASIC said a similar pay cut will be offered to the bank's top officials in phases.

In return for the action plan, the bank sought Tk 1,372 crore on an emergency basis from the government fund to meet its capital shortfall. As of June, the bank had a capital shortfall of Tk 1,675 crore.

The specialised bank in the action plan said due to its capital shortfall and the overwhelming negative image, many international banks are not accepting its letters of credits (LCs).

Ahmed said the matter has been taken care of. “It happened for a short period. The problem is over now -- there is nothing to worry about.”

He said the bank management sat down with those who hesitated in doing business and reassured them that they are now dealing with a new, improved and upright BASIC Bank.

Meanwhile, in the action plan sent to the bank and financial institutions division, BASIC said by 2016 it will: realise default loans amounting to Tk 1,000 crore, bring down the default loan volume to less than 35 percent and aim to make net profits of Tk 150 crore.

In December last year, the bank's net loss stood at Tk 53 crore,

It also set a target of increasing private deposit, which now stands at only 11 percent of the bank's deposits, to 25 percent in the next two years.

Some 250 proposals approved by the previous board have been suspended and the management asked to bring fresh proposals on a case-by-case basis.

The action plan also mentioned that efforts are being made to bring back the bank's 50 good borrowers who left due to the rampant corruption culture during the previous board's regime.

In July, the government recast the bank's board to be helmed by former Krishi Bank Chairman Alauddin A Majid.

The steps taken against the irregularities that occurred at the bank were also mentioned. The Anti-Corruption Commission is conducting an investigation and BASIC will take actions against the persons found responsible in the probe.

Furthermore, an audit firm will go through approved loans of Tk 1 crore and above to detect irregularities, if any.

The process of appointing the accountancy firm is underway, and actions will be taken against those against whom allegations are found correct in the audit report.

News:The Daily Star/15-Sep-2014

Comments