BB warns banks against anomalies

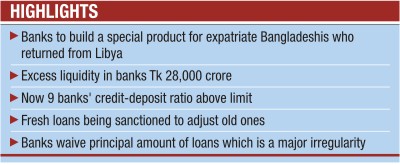

The Bangladesh Bank (BB) has detected various irregularities in commercial banks, including waiver of the principal amount of loans, and warned the banks against such malpractices.

The irregularities found through an investigation were presented at a meeting of the chief executives of all banks yesterday with the central bank Governor Atiur Rahman in the chair.

The irregularities were projected on the basis of the central bank's inspection to bank branches at different times.

The banks normally exempt the interest on loans but cannot forego the principal amount. The BB inspection also found incidents of waiving the principal amount.

Though the classified loans were not recovered, the banks were putting those as recovered to show a big amount of profit. Besides, the irregularities detected by the BB included granting loans to defaulters, and rescheduling classified loans without down payment.

The central bank also found that after giving fresh loans, the banks adjust the old loans, which is a big malpractice, BB officials said. The banks often declassify classified loans without following central bank rules, they said.

After the meeting yesterday, BB Deputy Governor Nazrul Huda said the real situation is not being reflected in the balance sheets of the banks due to such irregularities. He said: “We have asked the banks to be cautious in future; otherwise we will be tougher.”

In the meeting, various issues including the banks' liquidity and their exposure to the capital market were discussed.

Huda told journalists that the banks do not have any liquidity crisis now, though one or two banks are facing a little pressure. He said the amount of excess liquidity is about Tk 28,000 crore now and the rate of interest in call money market is between 4 percent and 6 percent.

The BB deputy governor said fresh money is being injected into the money market every day as the government's development expenditure is increasing now. The government has already released Tk 1,500 crore development funds, which gave a rise to liquidity in the banks.

Huda said export receipts are lagging behind export shipment by nearly $2 billion. Normally, the banks bring back the export receipts to the country within four months. “We have asked the banks to take initiative to bring back the export receipts in one month, giving special efforts to further improve the liquidity situation.”

In the meeting, the BB governor said: “I would strongly urge the bank CEOs to direct their export desk staffs in the respective branches to be active in timely collection of export bills from abroad.”

The governor also said the central bank will ease further the pressure on the taka-dollar exchange rate and interest rate.

Huda also said the credit-deposit ratio was beyond limit in different banks but it has come down. Now the ratio is above 85 percent in nine banks.

If the present trend continues, the credit-deposit ratio of these banks will come down below 85 percent by June, he added.

Huda said the ratio in 26 banks was above 85 percent only a few months back. He also said, another positive note was that the overall credit-deposit ratio of the banks is 82 percent.

The BB deputy governor said no bank has over-exposure to the capital market now.

The central bank has already started working on the basis of the share market debacle probe committee report. The BB will also form an investigation committee. If any irregularity is proved against any bank, the BB will take action.

Huda said the banks were advised to launch a new product to provide financial assistance to the Bangladeshi migrant workers who returned home from Libya.

The Association of Banks Bangladesh (ABB) will prepare the product after discussion.

Comments