Call money rate surges to 8.25pc

The inter-bank call money rate, at which banks lend and borrow between each other, rose to 8.25 percent yesterday, as some private banks rushed to borrow to meet their overnight demand.

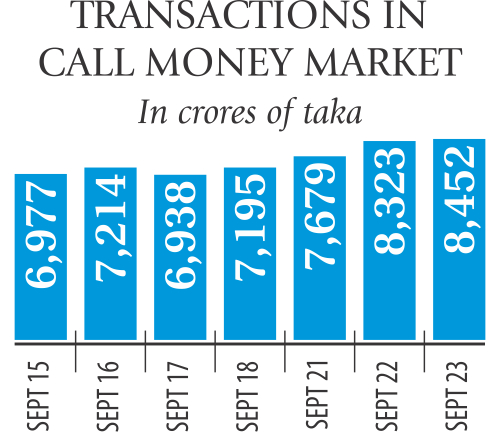

Total transactions in the market also increased in the past one week. A total of Tk 8,452 crore was transacted in the call money market yesterday, up by Tk 129 crore from the previous day, ahead of Eid-ul-Azha and Durga Puja.

“Credit offtake is gradually rising. Also, the seasonal demand for money is increasing,” said Anis A Khan, managing director of Mutual Trust Bank.

State banks—Agrani, Janata, Rupali and Sonali—were the major lenders with Tk 3,924 crore in the yesterday's call money market. Five foreign banks also lent Tk 668 crore.

Inter-bank call money market remained sluggish in the past several months, and the borrowing costs in this market was around 7 percent.

Bankers attributed this slowdown on their surplus funds. The call money rate generally increases significantly during festivals like Eid, but it was stable, within 10 percent, in the last two years.

“The rate has increased due to demands from tannery and leather businessmen. A huge amount of money will flow out of the banks to meet payments for wages and festival bonuses,” said a senior treasury official of Jamuna Bank.

The highest call money rate was 7 percent on September 15. The rate jumped to 8 percent on the following day and 8.25 percent yesterday. The lowest rate, which was 5.5 percent on September 15, rose to 6.4 percent yesterday.

Some bankers expected that the rate to rise further in the next week, the last few working days before the Eid.

Brac Bank borrowed Tk 801 crore, the highest, from the call money market yesterday, followed by Trust Bank Tk 627 crore, City Bank Tk 602 crore, AB Bank Tk 595 crore and NCC Bank Tk 450 crore, according to data from Bangladesh Bank.

Of the non-bank financial institutions, state-owned Investment Corporation of Bangladesh borrowed the highest, Tk 655 crore, followed by Lanka Bangla Tk 245 crore and IDLC Tk 230 crore.

Rupali and Sonali topped the list of lenders with Tk 1,150 crore and Tk 1,210 crore.

Of the private banks, Dutch-Bangla Bank lent the largest amount -- Tk 707 crore, followed by Mutual Trust Bank with Tk 367 crore.

Comments