Six stockbrokers suspended, as SEC spots share tricks

Sarwar A Chowdhury

Sarwar A Chowdhury

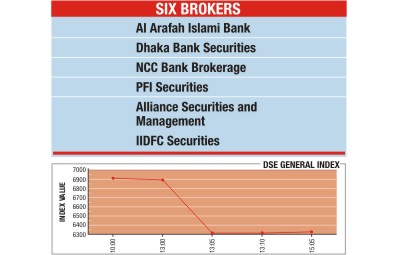

The stockmarket regulator yesterday suspended six stockbrokers' trading activities for 30 days on charges of their involvement in the ongoing volatility in the secondary market.

The Securities and Exchange Commission (SEC) took the action after trading was halted by the share index breaker within five minutes into the start of transactions. The benchmark index slumped by 600 points on Dhaka Stock Exchange before the circuit-breaker put brakes on trading on the twin bourses.

The suspended stockbrokers are Al Arafah Islami Bank, Dhaka Bank Securities, NCC Bank Brokerage, PFI Securities, Alliance Securities and Management and IIDFC Securities.

Also, the regulator stripped managing directors and chief executive officers of the six brokerage houses of official duties and responsibilities for the next 30 days. They are: Rezaur Rahman of Al Arafah Islami Bank, Kamrul Aziz Nippon of Dhaka Bank Securities, Manjum Ali of NCC Bank, Kazi Fariduddin Ahmed of PFI, Pankaj Roy of Alliance Securities, and Ashrafun Nessa of IIDFC.

SEC officials said the surveillance department of the commission found irregularities in the brokerage houses in a primary investigation. Buy offers came from these brokerage houses at comparatively higher prices, but sell-offs occurred at much lower prices than the buyers' offers, the officials said. There was a buy offer, for instance, at Tk 330 for a stock, but sellers sold it for Tk 300.

In another move, the stockmarket regulator postponed the book building method for initial public offers following heavy criticism by market experts and intermediaries.

In recent times, the book building method turned out to be a tool for manipulating prices in Bangladesh, although it is a widely practised price-fixing mechanism for IPOs, market analysts said.

At a press briefing yesterday, the Dhaka Stock Exchange said the companies that were listed under the book building system should be probed to find out how the price distortion took place by deceiving retail investors.

The book-building method was introduced in Bangladesh in 2009 and only three instances of such practices were found. But a number of companies are in the pipeline to list on the stockmarket under the system.

The SEC will also sit with all market stakeholders to discuss the market situation on Sunday, and the market will remain closed that day as decided by the regulator.

News: The Daily Star/Bangladesh/21 Jan 2011

Comments