Dhaka Stock Exchange

Profit-booking frenzy sends stocks tumbling

Dhaka Stock Exchange fell for the second day in a row, as investors, driven by the lure of profits, continued with their selling spree.

Dhaka Stock Exchange fell for the second day in a row, as investors, driven by the lure of profits, continued with their selling spree.

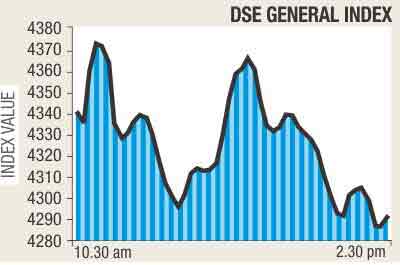

DGEN, the benchmark General Index of Dhaka Stock Exchange, finished the day at 4,291.87 points, after falling 49.38 points or 1.13 percent.

The market started the day on a flying note, gaining more than 50 points in the first hour of trading.

But as the day progressed investors selling pressure pushed the gauge down to red.

The uncertainty surrounding the funding of Padma Bridge is preventing investors from making fresh investments and even influencing them to reallocate their portfolio, IDLC Investment said in its market commentary.

Most of the large cap companies underwent price correction during the day, the merchant banker further said.

Most of the issues in the premier bourse faced price correction thanks to the overriding tendency for profit-booking, inferred Green Delta LR Holdings, a stockbroker, from its market research.

Turnover fell by 7.82 percent from the previous day to Tk 580 crore. A total of 1.48 lakh trades were executed, with 12.27 crore shares and mutual fund units changing hands on the premier bourse.

Of the total 269 issues that traded on the DSE floor, 127 advanced, 119 declined and 23 remained unchanged.

All the major sectors ended up in the red zone, with telecommunication leading the way having dropped by 4.61 percent.

Non-bank financial institutions (by 1.57 percent), power (by 1.51 percent) were the other notable losers.

Banks and pharmaceuticals lost as well, by 0.91 percent and 0.37 percent respectively.

Unique Hotel and Resorts was the top traded stock of the day thanks to its transaction of 28.20 lakh shares worth Tk 32.58 crore, followed by RN Spinning Mills and Meghna Petroleum.

Beximco Synthetics was the biggest gainer of the day, posting a rise of 9.25 percent.

ICB AMCL First Mutual Fund dropped by the most: by 8.98 percent.

The Selective Categories Index of Chittagong Stock Exchange closed the day at 8,247.89 points after falling 85.75 points or 1.09 percent.

Losers beat gainers 97 to 87, with 12 securities remaining unchanged on the port city bourse that registered transactions of 1.521 crore shares and mutual fund units worth Tk 64.84 crore.

News: Daily Star/Bangladesh/29-Aug-12

Tk 2b UCB bonds get SEC nod

The Securities and Exchange Commission (SEC) has given consent to United Commercial Bank (UCB) to issue floating rate subordinated bonds worth Tk 2 billion, only through private placement.

The consent of issuing bonds came under the provisions of the Securities and Exchange Commission (Issue of Capital) rules, 2001.

The approval was given on condition that the company shall comply with relevant laws and regulatory requirements, and shall also adhere to the conditions imposed

by the SEC under Section-2CC of the Securities

and Exchange Ordinance, 1969.

News: Daily Sun/Bangladesh/27-Aug-12

NBL to invest Tk 3b in stocks

The management of National Bank Limited (NBL) declared to invest Tk 3 billion in a bid to bring stability and restore investor’s confidence on share market.

The decision of investment in stock market came at board meeting of the Bank Monday.

A meeting source said the Bank took the decision to bring the market on a right track and restore investor’s confidence.

Earlier, four private banks--- NCC Bank, Standard Bank, Exim Bank and Pubali Bank declared to invest Tk 9 billion in the stock market to give funds support to ailing market.

Commenting on banks investment Akter H Sannamat, Managing Director of Union Capital told daily sun that this would give supports to the fund ridden market and help restore investors’ confidence.

The Daily Sun/Bangladesh/ 25th July 2012

Stocks rally for second day

Stocks gained 2.78 percent yesterday, the highest this month, owing to institutional investors' increasing participation in the market.

Stocks gained 2.78 percent yesterday, the highest this month, owing to institutional investors' increasing participation in the market.

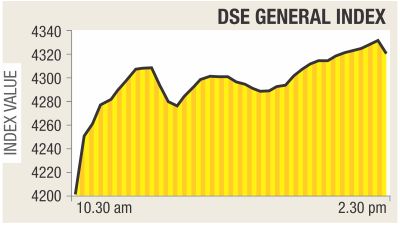

The rally continued for a second consecutive day as DGEN, the benchmark general index of the Dhaka Stock Exchange, gained 116.91 points to close the day at 4,318.79 points.

The opening 30 minutes of the day saw a rise of 110 points, and the momentum continued until the close of trade.

“Institutional investors, including banks, which publicised their intent to make fresh investments, followed up and bought shares, while some corporate dividend announcements, too, improved investor sentiment,” said Ahmed Rashid, senior vice president of the DSE.

Rashid added that the market is on its way to stability and is hopeful of a boost to small investors' confidence.

“New commitments from banking institutions reassured the investors that the liquidity would remain aplenty during the forthcoming period,” said LankaBangla Securities in its market analysis.

Latest policy decision by the government regarding the Padma bridge project also added to investors' positive outlook, it said.

“The rally went on for a second consecutive session, with improved turnover as well. Expectation of the rally persuaded investors to make fresh investments,” said IDLC Investments in its market commentary.

Turnover stood at Tk 289 crore, a 38.87 percent rise from the previous day.

A total of 0.89 lakh trades were executed on the premier bourse, with 6.58 crore shares and mutual fund units changing hands.

Among the major sectors, non-life insurance gained the most at 4.99 percent.

Non-bank financial institutions, power and textile were the other noteworthy movers, having risen by 3.97 percent, 2.66 percent and 2.37 percent respectively.

Of the 268 issues that traded on the DSE, 247 gained, 14 declined and seven remained unchanged.

Grameenphone was the top traded stock of the day, recording transactions of 6.85 lakh shares worth Tk 14.24 crore.

Beximco and Bangladesh Submarine Cable Company were the next popular stocks, registering figures of Tk 13.79 crore and Tk 12.64 crore respectively.

The biggest gainer of the day was Dhaka Insurance with its 9.98 percent rise, while Beximco lost the most, at 12.18 percent.

The Daily Star/Bangladesh/ 25th July 2012

Tax receipts fall as stock gloom lingers

The government's tax receipts from brokerage commission declined nearly by a half last fiscal year as a continuous downtrend reduced share transactions drastically on the Dhaka bourse.

The government's tax receipts from brokerage commission declined nearly by a half last fiscal year as a continuous downtrend reduced share transactions drastically on the Dhaka bourse.

The government received

Tk 169 crore in tax on brokerage commission in fiscal 2011-12, a 48 percent decline in tax collection over the previous fiscal year's Tk 326 crore.

The government also bagged Tk 102 crore in tax on share sales by sponsor shareholders and placement holders last fiscal year, registering a 16 percent fall over the previous year.

The decline in tax on brokerage commission, according to a fortnightly and a half yearly publication of the Dhaka Stock Exchange, was due to a massive fall in share transactions, both in terms of value and volume, on the premier bourse during the period.

Since January last year, when the market witnessed a debacle in share prices after an abnormal rise before, a downtrend has been continuing in the market.

Last year, the benchmark index of the prime bourse, DGEN, came down by 26 percent, while the value and volume dropped by 74 percent and 59 percent respectively.

On June 28 this year, the last trading day of fiscal 2011-12, the DGEN came down to 4,572 points from 6,157 points a year ago. The daily transaction value dropped to Tk 300 crore from Tk 1,139 crore, while the volume came down to six crore shares from 14.69 crore during the period.

Usually, the DSE management first collects the tax from stockbrokers on sell-buy commission and then submits the total amount to the National Board of Revenue at a rate of 0.05 percent.

The stockbrokers' contribution to the state coffer saw the decline due mainly to a massive fall in share transactions, both in value and volume, said Shuvra Kanti Choudhury, chief financial officer of the DSE.

“It is obvious that tax collection from the stockbrokers will fall if share transaction volume and value decline,” he said.

The Daily Star/Bangladesh/ 22th July 2012