Finance

NBR earnings soar Revenue rises 19.24pc in 10 months

Earnings by the tax administrator grew by 19.24 percent in the first 10 months of current fiscal year compared to the same period last year, thanks to a strong drive for tax mobilisation from domestic sources.

Earnings by the tax administrator grew by 19.24 percent in the first 10 months of current fiscal year compared to the same period last year, thanks to a strong drive for tax mobilisation from domestic sources.

However, the National Board of Revenue (NBR) has to collect more than Tk 21,000 crore in the remaining two months to meet the revised target for the entire fiscal year.

An NBR official said they are upbeat about earning more than the required amount in the next two months from the tax dodgers apart from the normal collection from taxpayers.

Being encouraged by the strong performance this year, the government plans to set a 22 percent higher target next year than the current fiscal year's original target, he said.According to NBR statistics, revenue earnings in the July-April period were Tk 71,065 crore, up from the target of Tk 69,787 crore.

The NBR official said they had a collection target of Tk 91,870 crore for the entire year. However, in the revised target the figure is going to be set at Tk 92,370 crore.

The current year's successes may encourage the NBR to set the next year's target at Tk 112,259 crore, 22.19 percent more than this fiscal year's original target.

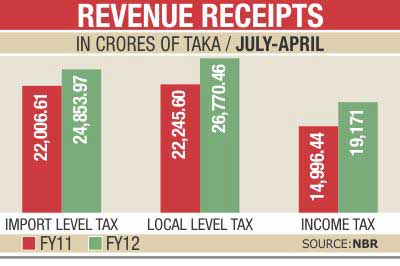

In the first 10 months this year, growth in income tax was 27.76 percent and VAT at the local level increased by 20.34 percent. However, revenue earnings rose by only 12.43 percent at the import level.

The official said both the government and the Bangladesh Bank took various steps to discourage import of unnecessary goods to ease pressure on the foreign currency reserve.

As a result, growth in revenue earnings at the import level is somewhat lower, he added.

The NBR has already formed two taskforces to speed up revenue collection. The taskforces have detected tax evasions by a good number of big companies. Revenues worth around Tk 2,000 crore may be realised from them, he said.

He also said an alternative dispute resolution has recently been introduced to fast-track settlement of tax-related cases out of court, which will spin off a handsome amount of revenue at the end of the year.

Another official said the NBR not only collected an increased amount of revenue from the private sector but also took steps to raise revenue earnings from the public sector.

The tax administrator realised a big amount of revenue from the state-owned mobile phone company and Bangladesh Petroleum Corporation.

The Daily Star/ Bangladesh/ 30-May-2012

Govt signs deal to install 335MW power plantProject cost estimated at $339.18m, WB to provide $221.10m

Finance Minister Abul Maal Abdul Muhith, seen at a contract signing ceremony at Biddyut Bhaban in Dhaka Monday.

Finance Minister Abul Maal Abdul Muhith, seen at a contract signing ceremony at Biddyut Bhaban in Dhaka Monday.

The long-coveted deal to install the Shiddhirganj 335-MW combined cycle power plant project was signed on Monday, eying on narrowing the mounting demand-supply gap of power.

Electricity Generation Company of Bangladesh (EGCB) Ltd, a concern of Bangladesh Power Development Board, sealed the deal with Spain-based joint-venture company comprised of ISOLUX Ingenieria SA and Sumsung C&T Corporation.

Officials hoped that the gas-based power plant would be 50 percent more efficient in terms of energy consumption compared to conventional ones, also helping to minimise the cost of power generation.

Total cost in the project is $339.18 million, of which the World Bank is providing $221.10 million. The government and EGCB Ltd will provide the rest to complete the project within the next 30 months.

With the new power plant, the share of power generation from quick rental power plants will come down to 7 percent of the country’s total power generation by 2016 from existing 21 percent, Finance Minister AMA Muhith said while speaking on the deal signing function as chief guest.

He said power consumption in the country has increased in recent years due to high economic growth, widening the demand-supply gap.

Energy Adviser to the Prime Minister Dr Tawfiq-e-Elahi Chowdhury, State Minister for Energy and Mineral Resources Eng Muhammad Enamul Huq, Power Division Secretary Abul Kalam Azad, World Bank Country Director Ellen Goldstein and chairman of EGCB Ltd Nilufar Ahmed were also present at the function.

EGCB company secretary Kazi Nazrul Islam, ISOLUX Managing Director Jose Garrido and Samsung C&T Corporation General Manager Sungki Na signed the contract for their respective companies.

Terming the project as a “life support project” for the country’s power sector, Dr Tawfiq-e-Elahi Chowdhury said, “It is indeed a very auspicious occasion for us.”

The combined cycle power plant will contribute much to energy efficiency along with cutting fuel costs for power generation, Tawfiq said, adding that power will be a key issue in maintaining the country’s economic growth rate over six percent.

He said the government has been able to increase power generation up to 5,500MW, from around 3,500MW, after taking office.

During the period, the government had to give two millions new connections while the demand for power at industrial units also increased manifolds, Tawfiq added.

World Bank Country Director Ellen Goldstein said the Shiddhirganj power plant will be the most inexpensive and most reliable power plant in Bangladesh.

She also hailed the bidding and procurement process of the project.

The WB country director called for creating a level playing field in the sector to attract more foreign private companies to invest in Bangladesh’s power sector. Earlier, the WB had committed to provide $221.10 million to implement two units of peaking power plant at Siddhirganj, each with capacity of generating 150MW of electricity.

But it later disagreed on a proposal to procure equipments from German firm Siemens over graft allegations. The WB then proposed the government to turn the project into a 335-450MW combined cycle one and assured to provide the total fund required for the project.

According to officials, state-owned EGCB invited a tender in October 2010 for the 300-450MW Siddhirganj power plant.

The project, undertaken in 2004, was delayed due to a long procedure of tendering and re-tendering as the authorities failed to satisfy the WB.

A tender was first invited in 2009 when it was a 300-MW peaking plant project. But the EGCB had to cancel it in response to a WB suggestion.

Later, as per Power Division’s instructions and World Bank’s suggestions, the EGCB upgraded the project to a 335-450MW combined cycle power plant and floated a tender in November 2010.

The Daily Sun/ Bangladesh/ 29-May-2012

DSE extends its losing streak

The benchmark index of the Dhaka Stock Exchange (DSE) went down last week for a third straight week as investors confidence eroded following fresh petitions challenging securities regulator’s directive on minimum shares holding.

Stock market analysts opined that the market witnessed downward move last week as investors’ confidence deteriorated due to fresh legal challenges of the minimum share holding by company directors in the High Court (HC).

During the week, the DGEN General Index of the premier bourse plunged 194 points or 3.88 per cent to close at 4,798 points.

The broader All Shares Price Index (DSI) also declined 158 points or 3.76 per cent to close at 4,055 points while the DSE-20 Index comprising blue-chip shares lost 117 points or 3.07 per cent to 3,680.

Meanwhile, a group of small stock investors staged demonstration in front of the DSE Building and blasted the SEC as they alleged that the market regulator had not taken its next course of action to compel directors to buy minimum shares as per its previous directive. They also blamed the SEC for the downtrend and cloudy situation in the market.

The week’s total turnover value came down to Tk 14.64 billion last week compared to Tk 17.87 billion in the previous week.

The average daily turnover value also went down and stood at Tk 2.92 billion which was 18.04 per cent lower compared to previous week’s Tk 3.57 billion.

The Daily Sun/ Bangladesh/ 27-May-2012

Sahara starts journey with primary investment of $125m

The Indian business giant Shahara Group will start its journey in Bangladesh with a primary investment of around US$125 million in housing project, said its Chairman on Friday.

Subrata Roy Sahara, Chairman of the group, spoke at a press conference to inform media about the updates of his visit to Bangladesh in a bid to look for investment opportunities.

Sahara Matribhumi Unnoyan Corporation Limited, a dedicated local concern of Shahara India Pariwar, also formally came to light yesterday, under which all investments will be made here.

The business tycoon said they already thought of a number of potential investment areas here; but not still specified.

"Now, I cannot tell you anything even if you ask me," he said adding: “Our investments will start with around $120 million to $125 million and this is just the beginning and more will follow.”

But investments might go to sectors like township development, education, health, tourism, hospitality and IT infrastructure development, he hinted.

Subrata Roy said they already placed a proposal of mega township project what he termed as “New Dhaka” to Bangladesh government to ease pressure on high-density Dhaka city.

The project will require around 0.1 million acres of land in outskirts of Dhaka, he informed the press.

He said the project will not create a jungle of concrete, instead it will provide total amenities supporting “lifestyle.”

“Shahara will bear the total cost and the Bangladesh government will only provide land and sovereign guarantee,” he said.

While his attention was drawn to country’s acute land scarcity, he said Sahara will not stick to any specific project but work for Bangladesh’s overall development at the same time doing sensible and responsible business.

“We have not come here only to concentrate on business but we want to work with social responsibility,” he said.

Shahara has already signed a MoU to build a modern housing estate for low-income group people.

The 'New Dhaka' project will also meet housing requirements of segments of urban dwellers, he informed.

He, however, did not sign any ties with local developers, saying: “We want to complement; not compete.”

About some investment barriers, Shahara Chairman said income tax difference between listed and non-listed companies is high here, calling for addressing such small issues.

"Even if I want I cannot be listed for the first three years and for that period I have to pay taxes at 37 percent, while a listed one has to pay 27 percent taxes, the difference is high," he said.

Under the present tax structure here, a listed company pays tax at 27.5 percent but non-listed firms pay 37.5 percent for only being non-listed firms here.

The man having familial roots here came to Dhaka on Tuesday on his first tour to Bangladesh.

Shahara Group Chief also rolled out, though not in detail, the group’s plan for country’s sports development, especially in cricket.

"Sahara logo is seen on the jersey of Indian cricket team and I am not announcing it but I can say it may be possible to see the same logo on the jersey of Bangladesh cricket team."

Replying to question regarding some suspicions about the much-talked-about investments, he said, "If somebody looks us with suspicion, it will dampen our spirit to work here."

“We want to work here. But if anybody publicise that we have political connection, we will lose interest to work here," he said when his attention was drawn to the political turmoil.

Asked whether political instability will harm their investments in future, the Indian business icon said there will be no problem as they love rules and regulations and like to stick to them.

Sheikh Fazle Fahim, the eldest son of senior Awami League leader Sheikh Fazlul Karim Selim, has been tasked with the directorship of the local concern of Shahara India Pariwar.

Shourov Bhattacharya, Deputy Director of the Shahara India Pariwar and a host of officials were also present at the press briefing and formal launching of its local concern.

The Daily Sun/ Bangladesh/ 26-May-2012

SMEs receive free training on tax, VAT

The SME Foundation started training the country's small and medium entrepreneurs on tax and value added tax for free to help them run businesses properly, officials said.

The state-run agency responsible for promoting SMEs across the country has taken steps to organise workshops in four divisional cities in the upcoming fiscal year of 2012-13.

Under the programme, a three-day training workshop to provide training to 40 SME entrepreneurs from Dhaka region began on Tuesday at the office of the foundation in Dhaka, said an official of the agency.

At the workshop, the participants got detailed ideas on topics tax and VAT laws, the loading and unloading system of imported and exported goods, and VAT registration and tax identification certificates.

Syed Rezwanul Kabir, chief executive officer of the SME Foundation, presided over the inaugurating ceremony. Farid Uddin, a member of the National Board of Revenue, and Mohammad Shahab Uddin, a former member of the NBR, were also present.

Forty entrepreneurs from Chittagong region already received training on tax and VAT related issues.

The foundation will organise the same workshop in Khulna and Rajshahi later.

The Daily Star/ Bangladesh/ 24-May-2012