Sticky

Government to allocate Tk5,000 crore to rescue four banks

Asif Showkat Kallol

In a bid to recapitalise four ailing state-owned banks, the government has decided to set aside Tk5,000 crore for the next fiscal year as per a recommendation by the International Monetary Fund under its extended credit facility (ECF) programme.

Seeking anonymity, a senior official of the Finance Division who is involved with budget preparations, said the government had no choice but to allocate the funds in the next budget as they were concerned about the financial health of four state-owned commercial banks in Bangladesh – Sonali, Janata, Agrani and Rupali.

The government gave Tk4,100 crore to the four banks in the outgoing fiscal year to help the banking sector recover from the setbacks caused by the Hall-Mark and Bismillah group scams, the official said.

Sources said the Finance Division would allocate the Tk5,000 crore only after reviewing whether the state-owned commercial banks had made substantial progress regarding an agreement with the central bank that had granted the previous Tk4,100 crore allocation.

The Finance Division would hold a meeting with the Bangladesh Bank to review the matter following the budget announcement, the sources added.

In April, the International Monetary Fund (IMF) asked the government to put aside Tk5,000 crore in the upcoming budget as capital for the four state-owned banks.

In its fifth review of the ECF, the IMF suggested that Tk1,500 crore of the total amount should be dispatched to the four banks by December this year and the rest by June 2015.

The multilateral lender, however, has instructed that certain conditions be tagged with the handout, so that the four banks are obligated to improve their performance and automate their branches by 2016.

The move comes after the IMF forecasted that the four banks’ capital position would deteriorate fast in the coming fiscal year, even though they have a capital surplus of Tk855 crore, according to the latest available data from December 31 last year.

According to Bangladesh Bank, the loan provision surplus of Sonali Bank and Janata Bank stood at Tk80.98 crore and Tk204.80 respectively at the end of March; the loan deficit of Rupali Bank stood at Tk319.92 crore; while Agrani Bank had no surplus or deficit provision of credit.

The banks’ capital position would run into a deficit for several issues, including the expiry of the central bank’s relaxed loan rescheduling policy in June, provisioning requirements for impending classified loans, and the shift in July to BASEL III standard which requires higher capital adequacy.

Meanwhile, the Bank Division of the Finance Ministry had sought Tk6,000 crore allocation in the upcoming budget for recapitalisation of the four state-owned banks, as well as seeking Tk700 crore for the same purpose for the state-owned specialised banks.

M Aslam Alam, secretary of the Bank and Financial Institutions Division, told the Dhaka Tribune that the four government banks needed more capital in the next fiscal year in line with Basel II.

Basel II, published in 2004, is an accord that intends to create an international standard for banking regulators to control how much capital banks need to put aside to guard against risks.

The four state-owned commercial banks are said to have been robbed off their safe footing by major scams such as those staged by the Hall-Mark and Bismillah groups.

“The balance sheets of the state banks should be streamlined in order to ensure their survival... The development partners think that the state banks may collapse because of capital shortfall. So, they want to see recapitalisation in steps,” the secretary said.

News:Dhaka Tribune/21-May-2014

State banks see surplus capital on public funds

Rejaul Karim Byron

State banks that had huge deficits earlier now enjoy surplus capital as the government has injected fresh funds into the banks and improved their asset quality.

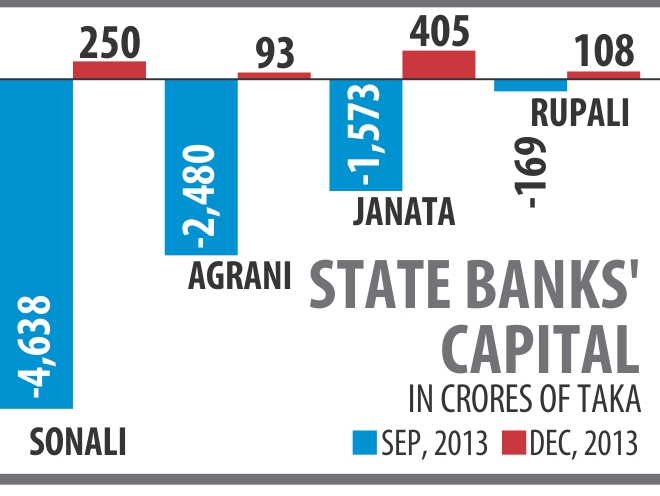

Four state-owned banks had a surplus capital of Tk 855 crore on December 31, 2013, though they had a deficit of Tk 8,863 crore on September 30, according to central bank statistics.

On December 31, the banks' requirement for total capital was Tk 10,554 crore against their risk weighted assets, but they maintained a capital of Tk 11,409 crore.

Their capital became surplus as the government injected money into the banks, an official of a state bank said.

The government provided the banks with Tk 4,100 crore in early December to help them meet their capital shortfall in line with conditions tagged by the International Monetary Fund with its loans under Extended Credit Facility.

Pradip Kumar Dutta, managing director of Sonali Bank, said they got Tk 1,995 crore to strengthen their capital base. Sonali also got some of its big loans rated which eased its capital requirement, Dutta said.

He also said they recovered a higher amount of classified loans in 2013 which has brought down their default loans and provisioning as well.

SM Aminur Rahman, managing director of Janata Bank, said, apart from getting money from the government they made a Tk 1,600 crore operating profit in 2013 which helped them meet their capital shortfall.

Rahman said they have brought down their classified loans to about 10 percent of their total outstanding loans, from 17 percent earlier.

The state banks' default loans rose to more than Tk 24,000 crore in the third quarter last year due to political unrest, irregularities in granting loans in 2012, and new loan classification rules of the central bank.

In early December last year, Bangladesh Bank instructed the banks to relax their loan rescheduling rules to provide some relief to the borrowers affected by political turmoil. The banks took advantage of the scope and reined in their classified loans.

In the last quarter of 2013, the state banks brought down their default loans by around Tk 8,000 crore. Though the banks had a provision shortfall of around Tk 500 crore against their default loans in September, the amount became a Tk 1,500 crore surplus in December.

Sonali Bank's cash recovery against its default loans was 272 percent in 2013 and that of Janata Bank 186 percent compared to those in 2012.

However, officials at the state banks said if the rescheduled loans are not monitored properly, the amount of default loans may increase again.

Dutta of Sonali Bank said they got the capital from the government against a business plan and they have started working to improve their capital situation.

The Janata Bank's MD said, “With the public fund we received we could create assets which will ultimately strengthen the bank's financial health further.”

News:The Daily Star/10-Mar-2014

Directors' loan from banks made difficult

Bangladesh Bank has imposed restrictions on the major shareholders of banking companies to ensure proper utilisation of fund of the banking companies and gain confidence of the depositors.

They will have to take board approval before taking financial facilities over Tk1 crore and let the central bank know about the privilege.

The facilities might come in terms of loans and advances, guarantees and other financial facilities, according to a circular Bangladesh Bank issued yesterday to comply with the amendments (up to 2013) to the Bank Company Act 1991. The circular takes immediate effect.

The major shareholders would be the individuals or companies having more than 5% stake in the bank.

The limit of financial facilities would be calculated with having the facilities to be enjoyed by the spouse or organisation having his or her own interest.

According to the circular, the loan or its part and net income interest should not be exempted, and in case of exemption, it should get prior approval from the central bank.

It also asked the bank-related persons to get prior approval by majority members of the respective bank boards for taking financial facilities from the banks.

The representative directors will have to take prior approval or guarantee from the respective board or similar authorities to get loans and advances or any other financial facilities from the bank.

The loan amount will have to be considered based on the amount of paid up capital of the shareholder institutions, and it should not be more than 50% of the paid up capital.

Loan or other financial facilities cannot be provided to independent directors or persons and institutions having relation with the independent directors.

A bank will not perform any transaction with the bank-related persons that would be easier than with the person not related to the bank.

All financial transactions with a bank-related person or in favour of his interest should be done through prior approval by the majority members of the bank board of directors.

Bangladesh Bank also imposed a restriction on the directors of banking companies not to borrow more than 50% of their respective paid up capital in the bank. In case, a director’s loan amount is more than 50%, it should be immediately raised to the bank board and informed the central bank.

The additional facilities being enjoyed by any director should be repaid within the stipulated time to be fixed by Bangladesh Bank. The additional amount cannot be renewed or its tenure be extended under no circumstance.

News:Dhaka Tribune/24-Feb-2014

BB warns banks against excessive exposure to stocks

The central bank yesterday warned banks against excessive exposure to the capital market, in a bid to ward off a bubble burst witnessed in the previous terms of Awami League.

Bangladesh Bank Governor Atiur Rahman came up with the warning at his first meeting with the chief executives of banks after a new government led by Awami League assumed power last month.

The money market and the capital market will complement each other within the law, and the central bank will strictly monitor all activities to prevent any deviation, he said.

Some banks are investing in the capital market beyond their permissible limit, which goes against the spirit of the recently amended banking law, Rahman said at the meeting at his office in Dhaka.

The governor discussed various issues, including the capital market, default loans and the overall macro-economic situation.

The stockmarket saw a boom when the Awami League-led government came to power in 2009. The market later went through a debacle, which analysts blamed on excessive investments by the banks.

SK Sur Chowdhury, BB deputy governor, told reporters after the meeting that the banks were asked to remain alert so that the crisis does not repeat.

Banks cannot invest more than 20 percent of their capital in the stockmarket, according to the amended banking companies act. The previous law allowed banks to invest 10 percent of their capital.

In line with the new law, the banks that invested more than the limit were asked to bring down the amount below the ceiling by July 2016.

The central bank found six banks have excessive investment in the capital market. The banks were asked to send a plan to the BB on how they would gradually bring down the amount to the acceptable level.

The amount of default loans decreased by 28 percent or Tk 16,137 crore in the fourth quarter last year. The BB governor said the amount fell as loans were rescheduled under a relaxed policy.

He also advised the banks to form a recovery unit to realise the bad loans.

News:The Daily Star/19-Feb-2014

Bad loan writing off norms set for micro lenders

The microcredit regulator has for the first time formulated a guideline on writing off bad loans for micro-finance institutions.

Presently, there is no specific guideline on writing off classified or bad loan for MFIs having loan recovery record of around 90%.

The Microcredit Regulatory Authority (MRA) recently formulated a uniform guideline to bring discipline in the credit disbursement system.

Under the new guideline, classified loans that remain as bad loans for two years and are kept as 100% provisioning will be eligible for writing off.

The oldest classified loan will have to be written off first and, if any fake or unidentified loan is found, the concerned institutions must inform the regulator before writing it off.

Approval of the board of directors of the institution requires before writing off the loan, and such writing off will have to be made either on June 30 or December 31 each year.

Even after writing off a loan, the MFIs will have to continue making efforts to realise the loan and after such loan realisation, they have to be shown as earnings.

Md Shazzad Hossain, a director of MRA, said microcredit institutions have a recovery record of more than 90% in Bangladesh. “From this point of view, that’s not important to make a write off guideline.”

What the MRA has been trying to do is to put the industry on the right track since its inception, he said.

“New rules and regulations is a step forward to develop the industry in accordance with the international standards.”

Since its inception in 2006, the MRA has been continuously making efforts for creating an enabling environment in the microfinance industry for its sustainable development by formulating new rules and regulations.

Bangladesh has become the first country in the world to establish a separate entity, MRA, under a separate act to license, monitor and oversee the MFIs, as microfinance had been a private sector initiative all along and flourished without any formal regulatory entity from the government in most parts of the world.

Though Bangladesh has been the pioneer of microcredit, it lagged behind some countries in enacting a regulatory framework for this sector. Over the years, it has brought a number of changes in its rules and regulations.

Presently, there are 732 MFIs or NGOs under MRA operating in the country. Of the MFIs, only five are very large, 21 large, 115 medium, and rest are small ones.

The country’s first microfinance institution Bangladesh Rural Advancement Committee (BRAC) was established in 1972 through which microfinance activities had started in Bangladesh.

News:Dhaka Tribune/18-Feb-2014